In some states, avoiding probate can mean avoiding extensive delays, costs and stress. In other states, laws have been updated to make the process less burdensome. Regardless of the laws, avoiding probate may still hold important advantages for many people, especially those who own property in multiple states. Going through probate in multiple states, and qualifying an executor in multiple states, inherently means multiple opportunities to encounter challenges, delays and legal hurdles. An estate plan that avoids probate can potentially allow your loved ones to bypass these potential pitfalls.

If you've done much research on the issue of avoiding-versus-not-avoiding probate, then you've likely read or heard the main arguments. One side extols the benefits of avoiding probate. The other side says that avoiding probate is not necessary because the probate administration process in many states is not that complicated or time-consuming. That latter statement can be true, to an extent. Some states have reformed their probate laws and, as a result, the probate process in those places is a lot easier than it used to be.

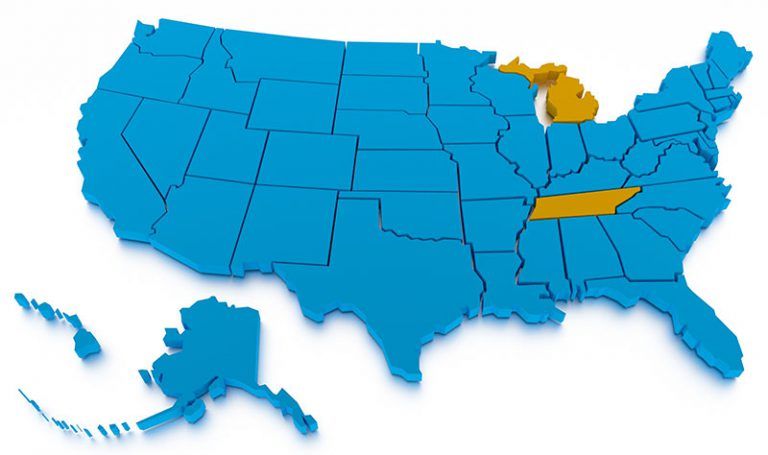

But that doesn't tell the whole story. Today, people's lives are more mobile than ever before, so the likelihood of owning property in multiple states is higher than ever. Take, for example, a fictional couple whom we'll call James and Sarah. James and Sarah used to live in California until they moved to Kentucky a few years ago. They weren't able to sell their home in California for an adequate price, so now they rent the home out. Recently, they inherited Sarah's parents' beach condo property in Florida, which Sarah's mother left to them in her estate plan. The condo was paid off, so they decided to keep it and use it for vacations.

Both James and Sarah have wills. Both wills name Sarah's cousin, Lauren, as their executors. Lauren lives in Ohio but, since she's an accountant, the couple decided she was the best person to handle the executor job.

So, what happens when the couple passes away? This means that three different probate administration case files must be opened: one each in Kentucky, California and Florida. Lauren must go through the process of qualifying as an executor in each of those states in order to carry out her duties.

While it is true that some states have simplified their probate processes, others haven't. If you own property in three or four different states, your estate has three or four chances of needing to go through probate in a place where it is not modernized, simplified and streamlined. Your estate has three or four chances to encounter a state where the laws erect substantial hurdles when it comes to allowing non-residents (like Lauren would be in each of James and Sarah's states) to serve as the executor of a will. (Florida, for example, has significant limitations.)

In other words, yes, some states have reformed their probate processes but, if you own property in multiple states, probate can still potentially be a massive headache, complete with delays, expenses, stress and legal barriers. So, how can you avoid this? One way is with a revocable living trust (RLT) A RLT allows your loved to avoid worrying about going through probate in multiple states. Fully and properly funded RLTs, by their legal nature, avoid probate, so if you have all of your appropriate assets funded into your RLT, then you won't need probate, regardless of how many states your assets are situation in.

Additionally, a plan with a RLT may also allow your loved ones to escape worrying about the executor qualification problem. While many states have considerable limitations when it comes to who may or may not serve as an executor in that location, the rules everywhere related to who may serve as the successor trustee of a RLT are much less stringent. The chances that your preferred person would be ineligible to serve as a successor trustee are comparatively slim.

So, yes, it is true that some states have changed their probate laws. It is also true that the probate process in some of those states is much easier, faster and inexpensive than it used to be. These truths do not, however, necessarily mean that avoiding probate isn't worthwhile. Depending on the makeup of your assets, avoiding probate with a plan that includes a RLT can still provide you with extensive benefits.