Naming the eldest child or surviving spouse to serve as your personal representative is a popular choice. The appointment may be an honor, but it can be a significant burden and put your legacy at risk if the personal representative lacks the necessary skills, temperament, willingness and emotional ability to administer your estate and carry out your wishes. You and those you select as a personal representative and alternates should have a clear understanding of the obligations and agree ahead of time to the arrangement.

Let's say your dad names you as his personal representative in his last will and testament.

Would you be honored and humbled to serve as his surrogate after his passing - or an emotional wreck, overwhelmed by the numerous administrative obligations during an intensely challenging time? Would you know of your assignment in advance and be prepared? Do you have any idea of the extent of the amount of work involved?

There's a lot to consider. The careful selection of your personal representative - also known as an executor or administrator of an estate - is important to maintain harmony among loved ones, fulfill your wishes and protect the legacy you want to leave behind.

For many people, the eldest child or surviving spouse is an obvious and traditional choice.

A knee-jerk choice, however, isn't necessarily the right one, experts say. Part of estate planning deals with controlling and managing your affairs when you no longer can or are no longer around. If you have the wrong person or people in place to honor your wishes, your plan is prone to spiral out of control.

Who should I appoint as a personal representative?

Choosing a person or people to follow your instructions, oversee the peaceful distribution of your assets and obey the legal formalities of administering an estate is one of the most important decisions you'll make as you develop a comprehensive plan.

"There's a time bomb ticking in many estate plans," warns Retirement Watch editor Bob Carlson. "The 'bomb' is the person, or people, you name to act for you. They can determine the fates of family relationships and financial security. The problem is most people don't realize the potential consequences of their surrogates' actions and don't give enough thought to who is appointed."

To diffuse the threat, your choice of personal representative must be comfortable with the role and qualified to perform its array of duties, from the immediacy of funeral arrangements and submitting the will to the court to distributing assets and resolving family disputes that could develop in the months and even years ahead, Carlson says. And if you wish to avoid a mess over how your affairs are handled, your surrogate should be free of personal conflicts and rivalries with your beneficiaries as well as other disqualifying issues.

Unfortunately, too many times the nomination of a personal representative is a complete surprise to the chosen person, who may be unprepared and unqualified to accept the role. The person or people you choose - which should include alternates in the event they predecease you, become incapacitated or are disqualified for some other reason - must have a clear understanding of the duties of a personal representative.

You need someone trustworthy who won't cook the books or loot belongings because of minimal supervision. Make sure your wishes and the obligations of administering your estate are discussed and agreed upon well ahead of time. Otherwise, your plan and the legacy you want to leave behind is at risk of failure.

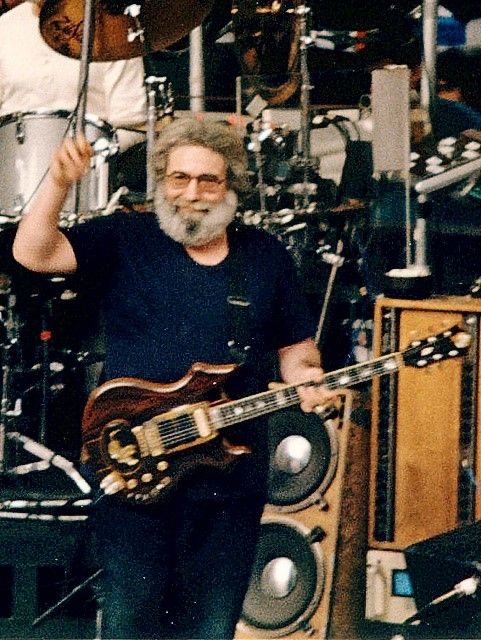

A lesson from Jerry Garcia

Although he made music for a living, Jerry Garcia never predicted the off-stage drama that followed his death in 1995 at age 53.

In his last will and testament, the Grateful Dead frontman named his wife, Deborah Koons, as his personal representative. After all, naming a spouse or adult child to oversee your affairs upon your passing is a common preference.

But in Garcia's case, the selection of his wife (which happened to be his third one) led to a less than harmonious outcome. The blended-family conflicts were numerous when you consider his surviving spouse was in charge of distributing large sums of money to Garcia's three daughters from previous marriages, a fourth daughter from a girlfriend, a stepdaughter and other beneficiaries.

Some $50 million in claims were levied against the estate, several times its estimated value, as family members sued for a bigger stake and acquaintances, former lovers and business partners sought a piece of the musician's legacy and his estate's future earnings.

Given the complexities of a blended family and Garcia's status as a psychedelic rock star, his choice for personal representative proved to be shortsighted.

"It was a lot to ask of Koons, whose first act was to immediately bar his two ex-wives from Garcia's funeral," recounts estate planning attorney Russell J. Fishkind.

She also stopped Garcia's payments to his second ex-wife.

The bottom line: "Blood and money do not always mix well," says lawyer and MoneySense columnist Ed Olkovich.

What are a personal representative's duties?

Your personal representative needs to be ready, willing and able. Beyond the emotional strain and challenges of family diplomacy, the personal representative has a lengthy list of chores.

For starters, all wills must be probated, and even if your loved one lacks a will and is declared intestate, the personal representative who is appointed by a judge will need to endure the court-supervised process that can take months to years to conclude.

"It is a serious role that requires your attention and possibly exposes you to personal liability. Be mindful of your obligations and truthful with yourself as to whether you are up to the responsibility and workload," observes Boston attorney Christine Fletcher, a Forbes contributor.

Experts agree that if you've agreed to be a personal representative, you'll quickly learn there's more to it than just reading a will and following a set of instructions.

"Administering a deceased person's estate requires a lot of thankless work," says attorney Daniel Timins, a Kiplinger contributor. The personal representative is a fiduciary and is legally required to prudently managing the estate's assets. The job can be time consuming and requires attention to many details, which can be difficult for someone who has just lost a loved one.

Estates vary in size and complexity, and the personal representative's to-do list can include everything from cleaning out the garage to paying taxes and closing the Facebook account. A corporate executor, such as an attorney or a bank's trust department, may be a better option depending the enormity of the assignment and your ability to find the right people to represent you.

The 'stressful stages' of probate

After locating the will, the personal representative "steps into your shoes" to perform legal duties on your behalf. Timins describes some of the actions required of personal representatives during the "four stressful stages" of probate. The stress, he says, comes from having to deal with governmental agencies and the probate court; gaining access to the decedent's financial assets, property and belongings; dealing with beneficiaries who are eager for an inheritance; and communicating with lawyers, accountants, financial institutions and online entities.

- Protecting estate property. Some immediate tasks are to locate the decedent's original will; cancel credit cards and online accounts; safeguard valuables and personal property from thieves and family members; collect and forward mail; gain access to the homestead; and obtain copies of the death certificate.

- Retaining a qualified lawyer and submit the will to the court. Select an attorney experienced in estate settlement matters to save time and expenses. The personal representative may have some out-of-pocket costs, such as a filing fee for the will, that must be documented for reimbursement. Copies of the will must be distributed to beneficiaries, and they return signed and notarized release forms to the estate's attorney.

- Administering the estate. Once the probate court officially appoints a personal representative, they can access estate property. "Now comes the hard work," Timins warns of this phase of the process. The personal representative will need to inventory the estate's assets and gather financial records; property may need to be sold or liquidated; and creditors and taxes need to be paid. In many cases, the personal representative will need to utilize an accountant or financial adviser for assistance.

- Paying the beneficiaries, the personal representative and closing the estate. Timins calls the final phase of a personal representative's obligations the "home stretch." There are a few more tasks to complete: produce a final accounting of the estate's assets and expenses and provide it to beneficiaries; reimburse and compensate the personal representative; and provide a final inventory of the estate's assets and distributions to the court. Beneficiaries must sign a release that the estate's affairs are in order so they can receive distributions. Depending on your state, there may be other requirements for the personal representative.

"The good news is that no one can force you to serve as an executor, so you don't have to put yourself through any of these issues if you don't want to," Timins says. "But remember that if you don't do it, someone else will have to, and they may not do any better of a job than you would have. And once you choose to act as an executor, you are almost always required to finish the job, even it turns out to be more than you signed up for."