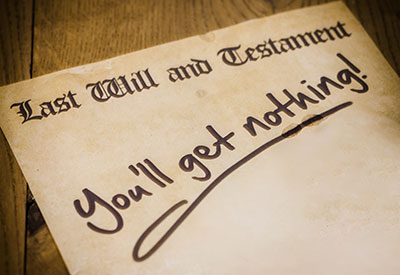

Estate planning sometimes involves parents making the difficult decision to exclude their children from inheriting their estate. The decision to disinherit a child can be driven by a variety of reasons and rationales, including encouraging independence, preventing harmful dependence, promoting philanthropy, ensuring fairness and instilling values.

The issue of disinheritance can be complex and emotional, but there are some common reasons why parents might choose to disinherit their children. Those reasons may include:

- Previous inheritance distribution. Sometimes, parents disinherit a child who has already received substantial financial gifts during their lifetime. This decision aims to balance things out among other family members who may not have received similar gifts.

- Lack of relationship. If there’s little or no relationship between a parent and a child, the parent might choose to exclude them from their will. Estrangement, emotional distance or strained connections can lead to this decision.

- Conflict of interest over lifestyle choices. Parents may disinherit a child due to disagreements about the child’s lifestyle choices. This could include conflicts related to career paths, personal values or other life decisions.

- Financial concerns. Parents might fear that their child lacks financial responsibility or judgment. They may worry that an inheritance could be mismanaged, fuel destructive behaviors or fall into the wrong hands (such as creditors or a problematic spouse).

- Divorce and stepchildren. In cases of divorce and remarriage, parents may choose to disinherit stepchildren from a previous marriage.

Remember that each family situation is unique, and emotions play a significant role in these decisions. If you’re facing such complexities, seeking legal advice or working with a financial professional can provide clarity and guidance.

In this article, we will explore these reasons and provide some examples from high-profile celebrities – including Sting, Matthew Perry, Mick Jagger, Simon Cowell, George Lucas and others – who have chosen this path.

Why do some parents exclude their children from inheriting their estate?

One reason parents may choose to exclude their children from their inheritance is to encourage independence and hard work. The belief is that providing a large sum of money can reduce a child's motivation to succeed on their own. Parents who have worked hard to build their wealth often want their children to experience the same sense of accomplishment and self-reliance.

Sting, the famous musician, has expressed this sentiment, stating that he doesn't want to leave his children "trust funds that are albatrosses round their necks," according to a cnbc.com report. He believes that his children should find their own path and earn their success without relying on an inheritance.

Mick Jagger, frontman of the Rolling Stones, has similar sentiments, telling The Wall Street Journal in an interview that his children shouldn’t expect his massive fortune to fall into their laps. “The children don’t need $500 million to live well,” he told the newspaper.

Meanwhile, administrators of the estate of actor Matthew Perry, who died in 2023, disclosed that the former “Friends” star explicitly stated in his last will and testament that he intentionally omitted “any provision for any of my heirs, issue, relatives or other persons who are not named. I also intentionally do not provide for any stepchildren or foster children that I now have or may later acquire,” according to a yahoo.com report.

Another significant reason for excluding children from an inheritance is to prevent harmful dependence. Large inheritances can sometimes lead to negative behaviors such as substance abuse, reckless spending or a lack of direction in life. Parents may worry that a significant windfall could harm their children's well-being and future prospects.

Simon Cowell, the television producer and talent show judge, has stated that he does not plan to leave his fortune to his son. Instead, he intends to donate his wealth to various charities, believing that inherited money could reduce his child's motivation to succeed independently.

Many wealthy individuals choose to leave their fortunes to charitable causes instead of their children. This decision often stems from a desire to address social issues and contribute to the greater good. By focusing on philanthropy, parents can ensure that their wealth has a positive impact on society.

Bill Gates and Warren Buffett are two high-profile examples of this approach. Both have committed to giving away the majority of their wealth through their philanthropic foundations. They believe that their children should create their own careers and contribute to society, rather than living off a large inheritance.

In some cases, parents may exclude children from their inheritance to ensure fairness and avoid family disputes. Dividing an estate equally among children and other causes can sometimes lead to disagreements and legal battles. By making a clear decision to exclude certain individuals, parents can prevent potential conflicts and ensure a smoother distribution of their assets.

George Lucas, the creator of “Star Wars,” sold Lucasfilm to Disney for over $4 billion and announced that he would use the proceeds to fund educational initiatives. This decision reflects his desire to use his wealth to benefit society while ensuring that his children do not rely solely on an inheritance.

Excluding children from an inheritance can also be a way to instill values and life lessons. Parents may want to teach their children the importance of hard work, responsibility and contributing to society. By not leaving a large inheritance, they hope to pass on these values and ensure that their children understand the importance of making their own way in the world.

One of the world's most famous investors, Warren Buffett, has pledged to give away more than 99% of his wealth to philanthropic causes. Buffett has consistently stated that he wants to leave his children enough money so that they can do anything but not so much that they can do nothing. This approach is meant to encourage his children to forge their own paths and achieve their own successes without relying on a massive inheritance.

Similar to Warren Buffett, Bill Gates has also committed to giving away the majority of his wealth through the Bill & Melinda Gates Foundation. Gates has expressed that he wants his children to create their own careers and not live off a large inheritance. By focusing on philanthropy, Gates aims to address global issues while ensuring his children understand the importance of contributing to society through their own efforts.

How can parents legally exclude children from inheritance?

To legally exclude children from inheritance, parents must explicitly state their intentions in their will or trust. Merely omitting a child's name may not be sufficient, as some states have laws that provide for the inheritance of omitted children. It is essential to use clear and specific language to avoid misunderstandings and potential legal challenges.

Parents can also include a no-contest clause, which states that any beneficiary who contests the will or trust will be disinherited. While not enforceable in all states, a no-contest clause can deter frivolous challenges. Additionally, consulting with an experienced estate planning attorney can help ensure that all legal requirements are met and the estate plan is enforceable.

What are the psychological effects on children who are disinherited?

Disinheriting children can have significant psychological effects, including feelings of rejection, inadequacy and loss. It can strain family relationships and lead to long-lasting emotional consequences. Children who are disinherited may struggle with questions about their worth and the reasons behind their parents' decision.

To mitigate these effects, parents should consider providing a letter of explanation outlining their reasons for disinheritance. This can help demonstrate their intentions and reduce the likelihood of misunderstandings. However, it is important to avoid language that could be perceived as vindictive or emotionally charged, as this may exacerbate negative feelings and legal disputes.

How does philanthropy influence estate planning decisions?

Philanthropy can play a significant role in estate planning decisions. Many wealthy individuals choose to leave their fortunes to charitable causes to address social issues and contribute to the greater good. This decision reflects their values and commitment to making a positive impact on society.

By focusing on philanthropy, parents can ensure that their wealth is used to benefit others and create lasting change. This approach can also help instill values of social responsibility and generosity in their children. Additionally, philanthropic estate planning can provide tax benefits and enhance the legacy of the individuals involved.

Can excluding children from inheritance cause family disputes?

Excluding children from inheritance can potentially cause family disputes, particularly if the decision is not clearly communicated or legally documented. Disinherited children may feel unfairly treated and seek legal recourse to contest the estate plan. This can lead to prolonged legal battles, emotional strain and financial costs.

To minimize the risk of disputes, parents should ensure that their estate planning documents are clear, specific and regularly updated. Including a no-contest clause and providing a letter of explanation can also help deter challenges. Consulting with an experienced estate planning attorney can further ensure that the estate plan is legally sound and less likely to be contested.

What alternatives to disinheritance can parents consider?

Instead of completely disinheriting children, parents can consider alternative methods to address their concerns. These alternatives include:

- Establishing a trust. A trust can provide greater control over how assets are distributed and managed. Parents can set specific conditions and guidelines for the distribution of trust assets, ensuring that their children receive support without a large lump sum.

- Lifetime gifts. Parents can provide financial support during their lifetime through gifts. This approach allows them to see the impact of their support and ensure that their children use the funds responsibly.

- Beneficiary designations. Designating beneficiaries on specific assets, such as life insurance policies or retirement accounts, can help ensure that certain assets pass directly to the intended recipients.

- Conditional inheritance. Parents can include conditions in their will or trust that must be met for the inheritance to be received. This can include requirements such as completing education or achieving certain milestones.

- Providing for basic needs. Parents can choose to provide for their children's basic needs, such as housing and education, without leaving a large inheritance. This approach ensures support while encouraging independence.

Conclusion

Deciding to exclude children from inheriting an estate is a complex and personal decision that can be driven by various reasons and rationales. Whether to encourage independence, prevent harmful dependence, promote philanthropy, ensure fairness or instill values, parents must carefully consider their unique circumstances and goals.

High-profile celebrities have made headlines for their decisions to exclude their children from inheriting their estates. Their reasons reflect a desire to promote hard work, self-sufficiency, social responsibility and fairness.

By understanding the potential psychological effects, legal implications and alternative options, parents can make informed decisions that align with their values and objectives. Consulting with experienced estate planning professionals can further ensure that their wishes are honored and their estate plan is legally sound.

Ultimately, the decision to exclude children from an inheritance should be made thoughtfully and with a clear understanding of its potential impact. With careful planning and communication, parents can create an estate plan that reflects their values and provides for their loved ones according to their desires.