One of the things clients sometimes ask lawyers is whether they can protect their assets by placing them within a corporation. The lawyer answers in the usual, exasperating way lawyers do: “It depends." But when it comes to this question, the answer really depends on just two things: whether you properly set up the corporation and followed the rules governing corporations and whether the creditor is suing you on an individual debt. We'll discuss both points below, but first, we need to outline the law of corporations.

Corporations are distinct entities in the law

The law considers a corporation to be an entity distinct from the owners of the corporation. The corporation is like a person, except that it does not have all the rights that a person has. A corporation may borrow money, do business, purchase and sell assets, make charitable contributions, enter into contracts and so on and so forth. About the only differences there are between a corporation and a person is that a corporation does not have a physical body and can't marry, divorce or vote. Otherwise, legally, corporations and people are treated pretty much the same.

How do you set up a corporation?

With limited exceptions, corporations are creatures of state law. To set up a corporation, you must file a document with the state. It is usually called “sections of Incorporation” but depending on the state, it might be called something else. sections of Incorporation are straightforward documents that name the person who is incorporating the corporation, name the registered agent for delivery of official papers by the state, establish the principal place of business for the corporation and sometimes identify the initial directors of the corporation.

While you are waiting for the state to approve your sections of incorporation, you draft bylaws and an organizational consent in lieu of the first meeting of the shareholders. The bylaws set forth how the corporation will be run, including such things as when the annual meeting will be, the purpose of the corporation, tax provisions relating to the corporation, and other mundane items. Normally, if everyone signs off on a consent, an organizational meeting need not be held. Whether there is actually a meeting or instead everyone signs a consent, the shareholders elect directors and appoint officers of corporations.

Finally, the corporation must obtain an Employer Identification Number (EIN) from the Internal Revenue Service for tax purposes. The corporation may then open a bank account using the EIN and the other corporate documents.

How are corporations run?

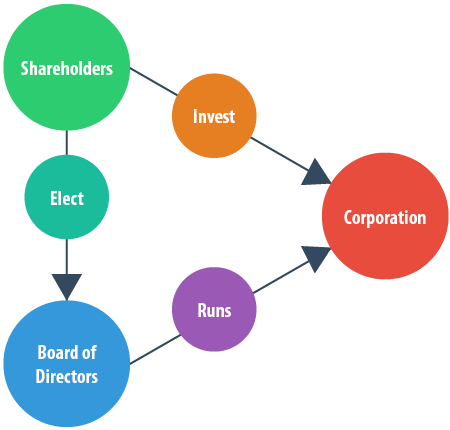

Corporations are owned by shareholders. There can be only one shareholder, or there can be many shareholders. The shareholders obtain their shares by contributing money or property to the corporation.

The shareholders elect the directors of the corporation. The directors are in charge of running the corporation. They exercise supervision over the corporate officers whom the shareholders also select.

Following the rules

Let's assume that you have properly set up a corporation and that, for purposes of discussion, you are the only shareholder. You have contributed money, property or both to the corporation in exchange for your shares of stock. At this point you must be careful to run the corporation according to the rules.

In short, the rules require you to treat the corporation as what it is: an entity distinct from yourself. That entity, as distinct from you, engages in business activities and is solely liable for its actions if it is sued.

The most you can lose as the shareholder of a corporation is the investment you made in the corporation by purchasing your shares and perhaps loans that you have made to the corporation. A creditor can't touch the personal assets that you did not contribute to the corporation. For this reason, corporations can be used for asset protection. Your personal assets cannot be subject to liability for corporate debt or judgments.

But if you break the rules …

If you do not follow you the rules governing corporations, then it is possible for your personal assets to become liable for corporate obligations. This doctrine is known in the law as "piercing the corporate veil," used for the first time in 1912. It refers to evidence of activities showing that you do not really treat the corporation as different from yourself.

Some of the most common evidence that you and the corporation are inseparable includes:

- Dipping into the corporate bank account without making a promissory note or loan agreement

- Paying for personal expenses with corporate money

- Failing to file tax returns or state-required corporate reports

- Not holding the required annual meetings of shareholders and directors, or failing to obtain written consents in lieu of holding those meetings

- Not keeping proper books and records

- Failing to memorialize meetings and corporate actions with corporate minutes

If you don't run your corporation according to the rules, then a court might well “pierce the corporate veil” to hold you personally liable for the obligations or debts of the corporation.

If you get sued on an individual debt

Let's look at the situation from the other end: Suppose that you personally entered into an agreement. Things didn't work out. The other side sued you and won a judgment against you. Are the assets that you have placed into the corporation liable for your judgment debt? Unfortunately for you, the answer is yes, they are, albeit indirectly.

When a creditor obtains a judgment against you, the creditor is entitled to a judgment lien. The lien gives the creditor the right to “execute” that lien. What this means is that that the creditor has the right to ask the sheriff to seize certain property of yours and sell it at public action to satisfy the creditor's judgment.

Some types of property are said to be “exempt from execution.” This means that the creditor may not have the sheriff seize and sell them. The best-known property that is exempt from execution is your homestead. Some states allow the entire homestead to be exempt from execution. Others allow a homestead to be exempt only up to a certain value.

But shares of stock in a corporation are not exempt from execution. In other words, a creditor could cause your shares of corporate stock to be seized and sold to satisfy the creditor's judgment. In that event, whoever bought the shares at public option would become the owner of your entire interest in the corporation. Thus, in this instance, the money or property that you put into the corporation would be lost.

The bottom line

Placing your assets into a corporation can be a good way to protect them. If you follow the rules, your individual assets are protected from liability resulting from corporate actions. For that reason, whenever possible, you should enter into contracts in the name of your corporation. That way, a creditor could not sue you individually for corporate obligations.