Life these days extends beyond the physical world with increasing numbers of people maintaining a digital existence on social media platforms and other online venues. Those who “live” in the digital world need to take into consideration the continuation or termination of their web-based presence upon incapacity or death. A key step is to develop an inventory of your digital assets and online accounts and provide instructions on how they should be handled for you by an authorized representative.

Like it or not, social media platforms dominate how we communicate with friends and family and have a say on the topics of the day.

These popular and pervasive platforms feed us endless streams of posts, links, commentary and click bait. In return, we contribute to the collective deluge by adding to our incremental “stories” on the popular apps that we rely upon to connect with billions of fellow users anywhere, anytime. With Facebook leading the way, digital venues over the past few decades have replaced water coolers as the preferred place for sharing gossip, reviewing “Dancing with the Stars,” showing off the grandkids, blowing off steam and curating cat videos.

In the digital age, we live online. If you don't, according to recent statistics, you are in a shrinking minority. Treasure troves of details about our lives, preferences, peeves and opinions live in cyberspace. Our data will survive long after we do and reside (some say forever) in stacks of servers and information-soaked clouds. Our texts, tweets, photos, videos, emails, likes, favorites, instant messages and other elements of our online existence can continue to speak for us long after we are silent.

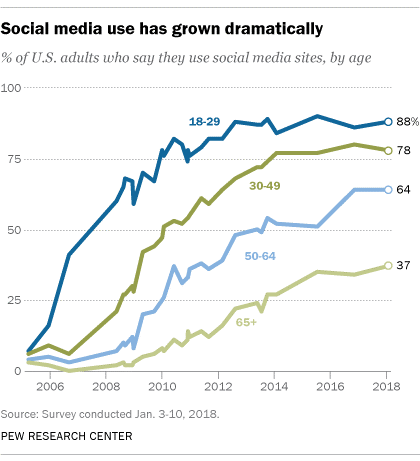

Year after year, the popularity of social media continues its steady rise. The percentage of adults using at least one social media site reached the 50% mark in 2011 and has steadily increased ever since, according to a 2018 Pew Research Center study.

Baby boomers make up a big chunk of the social media crowd. As of 2018, 64 percent of adults in the 50-64 age bracket used at least one social media site, and 37% of those 65 and older had gotten into the act. Leading the pack, of course, are young adults with 88% of the 18-29 cohort immersed in social media.

Older adults also are keeping up with technology. “Boomers are now far more likely to own a smartphone than they were in 2011 (67% now versus 25% then). Further, roughly half (52%) of boomers now say they own a tablet computer, and a majority (57%) now use social media,” Pew reported in May 2018.

Surveys show that Facebook remains the most popular social media site with 68% of U.S. adults using the platform. The other most popular social media platforms were Instagram (35%), Pinterest (29%), Snapchat (27%), LinkedIn (25%), Twitter (24%) and WhatsApp (22%).

“Currently, the generations most affected by digital asset transference are baby boomers and their heirs who are most likely to be passing without any provisions or instructions for transferring their online assets,” says attorney Laura McCarthy in an article published by Boston University.

As of 2016, there were 74 million baby boomers (born 1946 to 1964) living in the United States, according to Census estimates.

The numbers leave no doubt that our digital dealings are woven into the fabric of our lives. While we may ponder our own spiritual fate, it's also worth considering the afterlife of our online existence upon one's incapacity or death.

Do you have a plan for digital assets?

Control of your digital assets, just like all your other assets, should be part of both incapacity and postmortem planning, advises George Washington University law professor Naomi Cahn.

“Planning for digital assets requires contemplating mortality — just like drafting a trust, writing a will or executing an advance directive,” Cahn writes.

You may want your Facebook page to remain online as a “memorialized” presence, or your preference may be to have it permanently deleted. Perhaps you want to download your content from the site. Account owners should consider their various options while they are alive and well. Facebook also allows those with an eye on planning to appoint a “legacy contact” ahead of time who can manage the account in the event of incapacity or death. Instagram, Facebook's sister social media behemoth, allows accounts to be removed or memorialized with a big difference - the decision is out of the hands of the account owner, according to thedigitalbeyond.com. Instagram requires memorialization or deletion to be initiated by an authorized representative. Twitter has even stricter controls over the postmortem fate of its accounts, and rules vary among the other popular platforms.

Many of the instructions on how you wish your digital assets and online accounts to be handled can be contained in your planning documents. In your will, trust and power of attorney, you can authorize your executor, trustee or agent to follow your specific instructions regarding your digital legacy. The person in charge of your digital assets can act on your behalf to manage and maintain or close and dispose of your email and social media accounts based on your preferences.

There are a wide variety of digital assets beyond the social media realm, and many involve financial interests. Planning experts suggest creating an inventory of all your digital assets with the relevant user names, passwords and security questions as part of the instructions you pass along. The inventory may include online accounts for checking, savings, credit card, PayPal, Apple Pay, cloud storage, music services and others. Don't forget accounts for utilities, such as the cable or electric bill, and online retailers like Amazon, Wayfair and Overstock or membership clubs for meals, wine and other goods and services. Keeping a detailed inventory that lists all passwords and privacy protections does present a security concern, so precautions such as encryption and secure physical storage of the list are advised.

The transferability of control over online accounts is typically addressed by the service provider's terms of use in one of three ways: it's prohibited; it's allowed at the provider's discretion; or it's allowed at death with required documentation as proof. Don't count on providers to automatically disclose user names and passwords upon an account holder's death to surviving family members or legal representatives of the estate, since most will refuse.

As of 2018, 46 states had enacted the Fiduciary Access to Digital Assets Act, according to the Uniform Law Commission. As the name implies, states have enacted the act to extend “the traditional power of a fiduciary to manage tangible property to include management of a person's digital assets.”

FADA automatically gives fiduciaries - your executor, trustee or power of attorney - the authority to manage computer files, web domains and virtual currency. However, FADA requires authorized proxies receive consent in a will, trust or power of attorney documents to access and manage social media accounts - one's living embodiment online - as well as email accounts and text messages.

Can my 'friends' still 'like' me?

You can think of the instructions you leave behind as another type of will to add to the list of required planning documents. There's the traditional last will and testament - a cornerstone of estate planning and a document that 60 percent of Americans lack, according to a Caring.com survey. Another is the living will, also called an advance directive for health care, that states your wishes for end-of-life treatment.

The Information Age has initiated another informal type of planning document - dubbed by some as a “social media will.”

The government-sponsored website USA.gov encourages the creation of a social media will that addresses the future of your post-life online existence. The first suggested step is to create a statement that details for your executor, trustee or agent what you want done for each account.

USA.gov suggests that those with social media accounts take the following steps:

- Review privacy policies and terms and conditions of the social media platforms in which you are engaged

- Create instructions on how your profiles will be handled when you no longer can manage them

- Provide the person serving as the executor of your digital assets with a document listing the websites where you have a presence and include user names, passwords and security questions

- Require in your will that the executor of your digital assets be provided with a copy of your death certificate, which may be needed for the executor to act on your behalf

- Determine if social media platforms allow for proactive management of your accounts in the event of your incapacity or death

Facebook and Google are among the websites that allow the designation of a legacy contact who can manage digital accounts of he departed. The assignment of a digital assets proxy is a task that needs to be done while the account holder is alive. Meanwhile, there are other popular social media sites that do not allow legacy contacts. Among them are Twitter, Instagram, Pinterest and Snapchat.

For some sites, if accounts are dormant for a specified period, they may be closed due to inactivity. For those without a plan for their social media accounts, family members may be burdened with providing proof of the death and requesting that accounts be memorialized or deactivated by the host.

Your options for dealing with your digital afterlife depend on several factors, according to Singularityhub.com, a website that chronicles technological progress. “Companies like Google and Facebook have processes to let you choose who should take control of your accounts in the event of your death,” the website says. “But if you've forgotten to do that, the fate of your virtual remains comes down to a tangle of federal law, local law and tech company terms of service.”