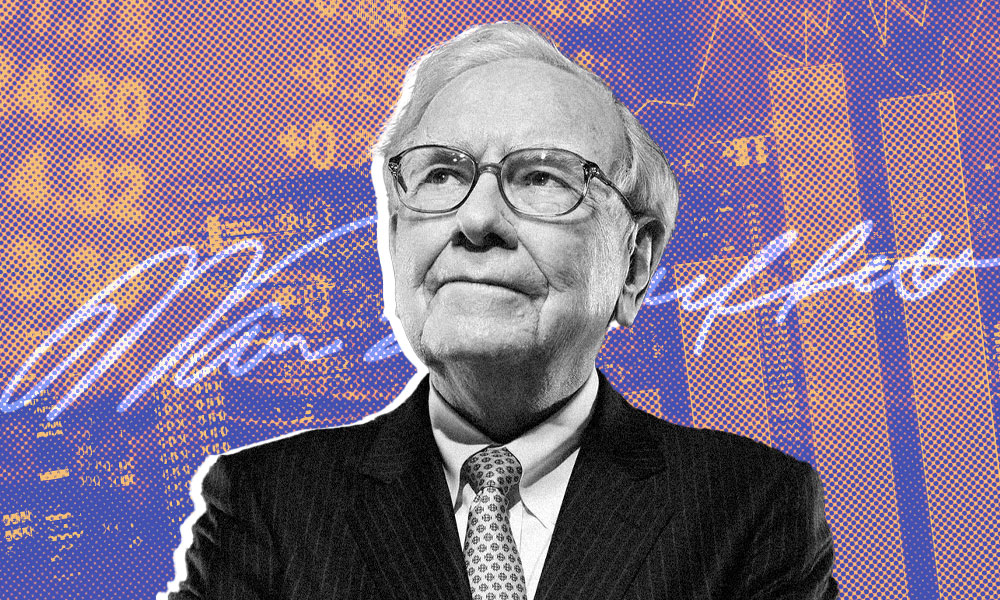

In a deeply personal yet instructive letter released just before Thanksgiving in 2024, legendary investor Warren Buffett, 94, announced he was committing another $1.15 billion of his vast fortune to charitable foundations. Beyond this significant financial announcement, the letter from Berkshire Hathaway's Oracle of Omaha also provided a masterclass in estate planning, offering some valuable insights applicable to families of all financial means. Through his characteristic blend of practical wisdom and philosophical reflection, Buffett illuminates crucial principles for the successful transfer of assets to the next generation and ways to preserve family harmony.

How does Warren Buffett approach family communication in estate planning?

Perhaps the most emphatic lesson from Buffett's 2024 letter is the critical importance of open communication in estate planning. "When your children are mature, have them read your will before you sign it," he advises, advocating for a level of transparency that many might find uncomfortable but which he deems essential. This approach allows children to understand the logic behind decisions and voice their questions while parents can still respond and explain their reasoning. Buffett's own practice of reviewing and updating his will every few years demonstrates that estate planning should be viewed as an ongoing dialogue rather than a one-time event.

What is Buffett's philosophy for inheritance distribution?

Central to Buffett's philosophy is the often-quoted principle that parents should "leave their children enough so they can do anything but not enough that they can do nothing." This balanced approach, demonstrated in his own family's experience when each child received $10 million upon their mother's death, represents their first substantial inheritance. The amount was significant enough to provide opportunity but not so large as to discourage personal achievement. This philosophy can be scaled appropriately for families of more modest means, focusing on the principle of enabling rather than inhibiting personal growth.

How can families prepare the next generation for wealth management?

Buffett's approach to preparing his children for their eventual responsibilities offers valuable lessons in succession planning. He and his first wife, Susie, encouraged their children in "small philanthropic activities" early on, allowing them to develop experience and judgment gradually. While he acknowledges they weren't initially ready to handle "staggering wealth," their measured exposure to philanthropic responsibility allowed them to grow into capable stewards of the family's legacy. This principle of graduated responsibility can be applied by any family, regardless of wealth level, in preparing the next generation for their future roles.

Meanwhile, the governance structures Buffett established provide practical insights for family wealth management. His requirement for unanimous voting on foundation decisions serves multiple purposes: ensuring careful consideration of grants, preventing hasty decisions and providing a diplomatic mechanism for declining requests. While the scale may differ, typical families can benefit from establishing clear decision-making structures for shared assets or responsibilities.

How do family values impact successful estate planning?

Throughout the letter, Buffett emphasizes that successful estate planning transcends mere financial considerations. He expresses pride not in his children's financial acumen but in their development as "good and productive citizens" who share common values while maintaining independent viewpoints. This focus on values transmission offers a crucial lesson: estate planning should prioritize the continuation of family principles and ethics alongside financial assets.

What are the best practices for family trust governance and succession?

Buffett's attention to practical governance details offers valuable insights for families of all sizes. His designation of successor trustees who are younger than his children demonstrates the importance of considering age and capability in choosing future stewards. His emphasis on keeping arrangements simple to avoid family conflicts provides a crucial reminder that complexity often breeds discord.

What makes an estate plan truly effective for your family?

The letter demonstrates that effective estate planning must be personalized to each family's circumstances and values. Buffett's requirement for unanimous voting among his children might not work for larger families, as he acknowledges, but the principle of creating clear, workable decision-making processes remains valid.

A subtle but significant theme in Buffett's letter is the importance of treating children fairly. He specifically warns against favoring sons over daughters, noting how such inequities often lead to family strife. This principle of equity, though not necessarily equality, represents a crucial consideration for any family's estate planning.

A list of 10 key estate planning lessons from Warren Buffet

From Warren Buffett's thoughtful 2024 letter, there are several valuable estate planning lessons and priorities that typical families can apply, even if they're working with much more modest assets:

-

Early communication and transparency

- Buffett strongly advocates having children read the will before it's signed, allowing them to understand the logic and ask questions.

- This transparency helps prevent confusion, anger and family conflicts after death.

- He emphasizes that it's better to explain decisions while alive rather than leaving children asking "Why?" after you're gone.

- Regular updates and revisions to the will (he mentions doing so every couple years) help keep it current with family circumstances

-

Clear philosophy on inheritance

- Buffett shares his famous philosophy that parents should "leave their children enough so they can do anything but not enough that they can do nothing."

- This balanced approach encourages independence while providing opportunity.

- The goal is to support children's growth and potential without creating dependency or entitlement.

- Typical families can apply this principle proportionally to their means.

-

Focus on values over valuables

- Buffett emphasizes passing down values rather than just wealth.

- He notes with pride how his children learned philanthropic values and developed their own views while maintaining common core values.

- For typical families, this means actively demonstrating and teaching important values during one's lifetime.

- The focus should be on raising "good and productive citizens" rather than just wealth transfer.

-

Fair treatment and gender equality

- Buffett specifically mentions how family disputes often arise when sons are favored over daughters.

- He warns against creating jealousies through unequal treatment.

- This applies to both monetary distributions and positions of responsibility.

- Typical families should consider carefully how to treat children equitably, even if not exactly equally.

-

Practical governance structures

- While Buffett's unanimous voting requirement for foundation decisions is specific to his situation, the underlying principle applies broadly.

- Creating clear decision-making structures helps prevent conflict.

- For typical families, this might mean clearly defining who makes what decisions about family assets or care.

- Having clear structures in place before they're needed prevents confusion and conflict.

-

Start early and build experience

- Buffett mentions how he and his wife encouraged their children in "small philanthropic activities" early on.

- This gave them experience before handling larger responsibilities.

- Typical families can similarly give children graduated responsibility with money and decision-making.

- This provides practical experience and helps develop judgment.

-

Carefully consider successor trustees/executors

- Buffett designates potential successor trustees who are younger than his children.

- This consideration of age and capability in choosing successors is important for any estate plan.

- Typical families should think carefully about who will manage affairs if primary choices are unable to serve.

-

Simple over complex

- Buffett emphasizes keeping things simple in estate planning.

- Complex arrangements often lead to confusion and conflict.

- Typical families should avoid unnecessarily complicated structures unless there's a compelling reason.

-

Regular review and updates

- The letter mentions changing his will every couple of years.

- Regular reviews ensure the plan stays current with family circumstances and wishes.

- Typical families should similarly review their plans periodically, especially after major life events.

-

Avoid dynasty building

- While Buffett's context is different, his warning about extending control too far into the future is relevant.

- He recognizes the difficulty of predicting future circumstances and needs.

- Typical families should focus on immediate generations rather than trying to control assets far into the future.

Conclusion

Warren Buffett's letter offers a comprehensive framework for approaching estate planning that emphasizes communication, gradual preparation, clear structures and strong values. While few families will deal with the scale of wealth discussed in his letter, the principles he outlines are universally applicable. His insights suggest that successful estate planning requires a delicate balance of practical and philosophical considerations, always keeping family harmony and individual growth at the forefront. The letter serves as a reminder that estate planning is not merely about transferring assets but about perpetuating values and preparing future generations for the responsibilities they will inherit.