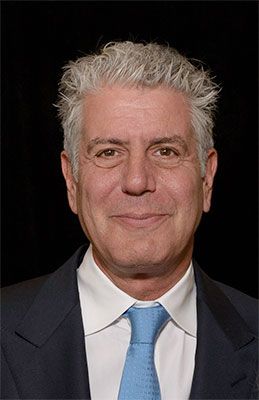

Celebrity chef Anthony Bourdain and fashion mogul Kate Spade had a terrible burden in common - depression - when they committed suicide within days of each other in June 2018.

Their deaths left their large, loyal followings saddened and dismayed. But Bourdain, 61, and Spade, 55, did share a blessing in common. Both were parents of daughters (ages 11 and 13, respectively). Bourdain, like Spade, was married but separated.

From an estate planning perspective, their mutual marital status serves as a reminder that difficulties may loom for separated couples who are not legally divorced when an unexpected death occurs. Intentions about one's legacy and priorities change with life's situations, which is why estate planning documents need to keep pace with a family's ever-changing framework.

In these modern times, it's not unusual for spouses to decide to remain married, but separated, to preserve the family unit in the best interest of their minor children. Estranged spouses may reason that staying married provides a sense of stability for a child whose parents are in a shaky relationship. This appears to be the case for Bourdain and his estranged wife, a former celebrity MMA athlete. They reportedly had an amicable relationship and remained “together,” despite their separation, for their young daughter. Their careers and frequent travel led the couple to splinter yet remain united in terms of caring for their child.

“As a family, I think we've done a really good job and we're doing a really good job and would like to keep it that way,” Bourdain told People magazine after their split in 2016. “As a marriage, clearly it's not ideal, but there's no injured party here, nobody's angry, nobody feels like the injured party, nobody feels like a victim. So, we'll proceed like that.”

Similarly, in the case of Spade and her spouse, the estranged couple was motivated by the interests of their daughter. Spade and her business-partner husband, although living apart from one another, remained close, according to media reports. Spade's husband, Andy, released a statement to The New York Times, saying their daughter “was our priority” and they were “co-parenting” her. Mr. Spade said they were not legally separated and had not discussed divorce.

Details about Spade's estate have not been reported, but provisions in Bourdain's will have raised some eyebrows. Bourdain's probate estate is valued at about $1.2 million, and he's leaving most of those assets to his daughter. The host of CNN's “Parts Unknown” named his estranged wife as executor of his estate, and he left his wife his personal and household effects - and his frequent-flyer miles. Bourdain also did not name a guardian to oversee his daughter's inheritance; it's a role his estranged wife likely will assume.

When Bourdain named his spouse as executor of his estate, it meant his estranged wife was responsible for handling funeral arrangements and other sensitive details surrounding Bourdain's legacy as part of her duties administering his estate. Fortunately for Bourdain, their relationship was considered to be amicable.

What to do when a marriage is a mess?

About 45 percent of married couples in the United States divorce, according to the American Psychological Association. Before taking the ultimate step, couples in many cases decide to separate but remain married for a variety of reasons. Spade and Bourdain, for example, stayed married in the best interests of their daughters but lived apart from their spouses.

When marriages are in meltdown mode, one option for couples without a prenuptial agreement is a postnuptial agreement. A postnuptial agreement can define ahead of time how property would be distributed in the event of a divorce and keep the matter out of often messy dissolution proceedings.

Being separated or simply living apart, however, does not terminate spousal rights. Legal separations are like divorces in that a court approves the division of finances and marital assets and makes decisions on child custody and support. The key difference is that legal separations, like informal separations, don't impact spousal inheritance rights; only divorce and a dissolution decree signed by a judge will end those obligations. Also, separations can be reversed, but divorces cannot.

For Bourdain and Spade, they remained unhappily married, and their estranged spouses retained their rights to their shares of the estates. In many states, the surviving spouse is entitled to half or more of the assets and cannot be disinherited.

Proper estate planning, however, can give estranged couples some immediate independence in certain areas before a divorce is finalized. Having a will is a key first step; otherwise, intestacy laws automatically will require that at least half your estate goes to your spouse. Because divorces can take years to resolve, it's suggested you revise your estate planning documents in case you die before the divorce is finalized. Trusts also may require revision, especially if members of an estranged spouse's family are designated as successor trustees.

If a vengeful spouse is something to fear - like one who has the power to “pull the plug” - there are other estate planning factors to consider. An advance health care directive can designate who has authority to make decisions about your medical care and in the event of your incapacity as well as funeral arrangements (or lack thereof) at your death. A power of attorney for financial matters also can be appointed, and that person does not have to be a spouse. Also, an individual's living will can control who would serve as one's guardian if incapacity is declared. Those estate planning documents can limit the control of a warring spouse.

Divorcesource.com considers durable powers of attorney to be potential “loaded guns” in the context of spousal discord, and there are numerous instances where estranged spouses have used the authority “to transfer their spouse's assets to them, take out loans in the name of their spouse, etc. If you have given your spouse a durable power of attorney, you should consider revoking it immediately so that it cannot be used in an unintended fashion.”

Another consideration is beneficiary designations. Spouses typically designate their other half to receive proceeds from life insurance and retirement plans. Federal law requires that spouses are sole beneficiaries of company pension and 401(k) plans unless a written waiver has been signed by the survivor. Laws vary, but all states grant spouses a share of the estate, regardless of what the other spouse's will dictates. Prenuptial and postnuptial agreements, of course, can alter those inheritance rights.

When couples split and divorce proceedings are underway, experts suggest drafting a formal separation agreement regarding property, debts, child custody and support and other issues that include estate planning. One part of the agreement may include a provision to waive rights to a share of the other's estate if one spouse dies before the divorce is finalized. Spouses who stand to inherit from their parents or other family members also may want to take action. If a parent or relative leaves an inheritance to an heir whose divorce isn't finalized, the estranged spouse still would be entitled to a share of the proceeds. The parent or relative may choose to utilize a trust to distribute assets directly to the recipient's intended beneficiaries, such as children or new paramour, and bypass the estranged spouse in the event the recipient dies before a divorce is final.

When a divorce is finalized, entire estate plans should be reviewed and updated to reflect new priorities for your legacy. Items that may require revisions are numerous and include: wills; revocable trusts; power-of-attorney designations; advance directives for health care; real estate deeds; titles for vehicles and other assets; beneficiary declarations for life insurance policies, retirement accounts, annuities, payable-on-death accounts and transfer-on-death deeds; and online account information including usernames, passwords and social media access.

There are numerous options and scenarios to consider when developing an estate plan that protects your legacy and achieves your objectives, and important decisions should be made with the advice of qualified lawyers and financial experts. Membership with Legacy Assurance Plan provides members with valuable resources and guidance to develop comprehensive estate plans that take life's contingencies into consideration and leave a positive impact for generations to come. Legacy Assurance Plan members also receive peace of mind that a team of trusted, experienced professionals will assist them in developing legal, financial and tax strategies that will meet their needs today and for years to come through periodic reviews.