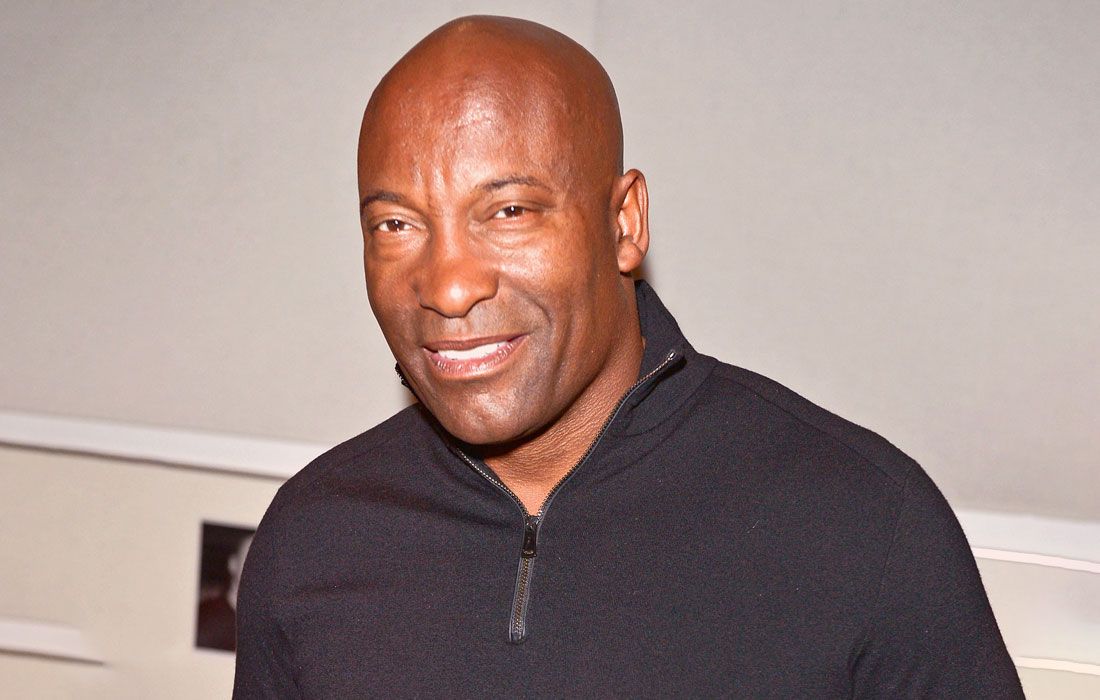

When Oscar-nominated filmmaker John Singleton suffered a stroke and slipped into a coma on April 17, 2019, his loved ones gathered at his bedside in Los Angeles.

Then they hired attorneys.

Online tabloid TMZ reports that a “family war” quickly erupted over control of his business affairs and bank accounts, pitting his mother, Shelia Ward, against other loved ones over guardianship for the Hollywood star.

Sadly, the 51-year-old director of “Boyz N the Hood” fame died 13 days later, unaware of a real-life legal drama that began shortly after he fell ill and continues after his passing.

As Singleton languished in the hospital, Ward filed a guardianship petition to act on her son's behalf, arguing she needed to finalize lucrative business deals with fast-approaching deadlines. Ward included a doctor's statement that the Hollywood star was incapacitated and unable to make decisions about his medical treatment or financial affairs.

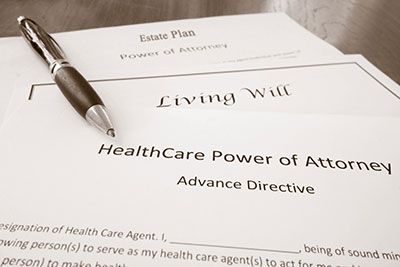

Singleton did not have powers of attorney for health care and finances or an advance directive to address end-of-life treatment. Without those documents, Singleton left the burden on his family to agree - or disagree - on managing his affairs.

Consequently, other family members quickly jumped into the fray, including a 19-year-old daughter and Singleton's estranged father. They hired their own attorneys to fight the guardianship petition. They questioned the motives of Singleton's mother, accusing her of rushing to take over his bank accounts.

When Singleton died, the guardianship question became moot, but the stage was set for the next round of the family's court fight when Ward filed her son's last will and testament.

Singleton signed his will in 1993 but never updated the document, causing another significant estate planning problem that could have been prevented.

Singleton named his newborn daughter at the time, Justice Singleton, as his sole beneficiary. In the 26 years since, Singleton fathered six more children with different women - but he never updated his will to reflect the additions to his family.

Besides inheritance issues, Singleton also neglected an important responsibility, the nomination of guardians in his will for his minor children.

Although his full estate is valued at $38 million, most of his assets are presumably held in a trust. Information about trust assets, successor trustees and beneficiaries has remained private. However, legal experts expect his survivors, especially his adult children and mother, to demand a full accounting of the entire estate, including his trust and other non-probate assets because of the botched will.

In fact, the will is at risk of being revoked entirely, which would make his seven children - not just his eldest daughter - his lawful heirs under state intestacy laws. If that's the case, the wishes that Singleton expressed in his decades-old last will and testament would be disregarded.

In the meantime, the distribution of an estimated $3.4 million as part of his probate estate, as well as control over those new lucrative business deals, is at stake. What happens at the courthouse in the coming weeks and months will determine who controls Singleton's probate estate and who will benefit from it.

What are the estate planning lessons?

Much of the infighting, embarrassing headlines, confusion and mounting legal costs involving the Singleton family could have been avoided with a complete estate plan that was regularly updated. Singleton, at best, had a limited estate plan that is so outdated that it has led to family discord, uncertainty and negative publicity. His unfortunate experience, however, provides some lessons in estate planning.

- Create a comprehensive plan for life and beyond. Create a comprehensive plan for life and beyond. A last will and testament alone - even if it's kept up to date - is only part of an estate plan. While an important component of your plan to distribute certain property, appoint a personal representative and name guardians for minor children, a will is effective only after you die and must be probated. Another key planning tool, a revocable living trust, distributes assets outside of probate and enables your successor trustee to control trust assets, according to your instructions, if you become incapacitated and distribute and manage them after you die. Powers of attorney, in which you choose your own surrogate decision makers, can help prevent guardianship petitions. An advance directive expresses your end-of-life treatment preferences, easing the burden on loved ones. When immediate control is needed, there's no time to wait on a guardianship or probate petition that may take weeks to be considered. Powers of attorney and successor trustees can step in immediately to deal pressing medical, financial and business issues.

- Plan for events during your lifetime. Much of estate planning is about making decisions ahead of time to deal with unexpected events that take place during life. Illnesses and accidents that lead to incapacity require the appointment of people to act on your behalf. In Singleton's case, he took no action to prevent the legal wrangling over his own medical emergency. He lacked powers of attorney for health care and finances and an advance directive. Without those documents, family members went to court to establish the control that he squandered. When he suffered his debilitating stroke, loved ones were forced to petition a court instead of relying on the legal paperwork that may have preserved family harmony and privacy.

- Update your will. Singleton may have been inspired to execute his last will and testament when his first child was born. Now, others have been inspired to sue his estate over a 26-year-old document. To remain valid and less prone to legally challenges, wills should be updated to reflect marriages, divorces, births, adoptions, deaths and other changes in family relationships. Your choice of guardians or personal representatives also may require adjustments over time.

- Name your children in your will. Singleton failed to include or exclude his children who were born after the will's creation as heirs. Now, the entire will and all its provisions may be invalidated. California and other states have protections for disinherited children. As a matter of public policy, children are entitled to a share of a deceased parent's assets unless they are specifically named and expressly disinherited in the will. Unless you live in Louisiana, you have a right to disinherit a child. Parents have may reasons for that decision, but simply ignoring them in the will won't accomplish that goal.

- Name guardians for your minor children. Your last will and testament is the place where you name guardians for your minor children in the event of your death. This role is usually filled by the surviving parent. If there's no surviving parent or both parents die at the same time, a judge will rely upon the instructions of a will to appoint guardians. Without guidance from your will, a judge will make the decision, regardless of your intentions.