For unmarried couples, estate planning is necessary to ensure that a healthy partner can manage finances and medical care if the other partner becomes incapacitated. A revocable living trust and powers of attorney are among formal arrangements that can give an unmarried partner the resources, rights and protections that a spouse enjoys by default.

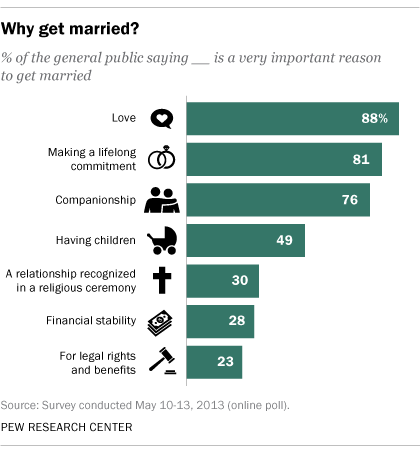

Love may be blind, but surveys about matrimony over the past half century have a clear message. Marriage in America is undergoing a cultural shift as its popularity continues a steady decades-long decline.

Since 2007, the number of Americans who live with an unmarried partner increased 29% to an estimated 18 million as of 2016, according to a Pew Research Center study. In 1960, the number was a mere 17,000.

In the past decade, the number of unmarried couples has risen fastest among Americans age 50 and older, growing by 75%, Pew reports.

Of all cohabitating adults in the U.S., 23% are over age 50. Nearly a quarter of older Americans prefer living together as a couple without formal strings attached.

You'll find many reasons for the trend, which is even more pronounced among millennials. Weddings are expensive. Divorce rates remain high. People may be hesitant the second time around.

Marriage, although expensive and risky, bestows each partner with rights, privileges and advantages involving access to community property and assets, Social Security, retirement benefits, taxes, inheritance and decision-making authority regarding medical treatment and access to information. By default, a spouse has next-of-kin status, hospital visitation privileges, child custody rights and other prerogatives.

“Marriage is a one-size-fits-all arrangement,” attorney Diana Adams tells popsugar.com. “Marriage comes with over a thousand different rights and responsibilities, to be each other's financial safety net and share each other's debts and assets as a social welfare state of two.”

Do unmarried couples have special rights?

For unmarried couples, none of those built-in advantages of marriage exist. Informal commitments, although heartfelt and based on love and devotion, carry no legal weight and can lead to unintended outcomes especially when one partner is the breadwinner, and one is financially dependent.

Consider the scenario of one partner with a lucrative career and significant assets. While one pays the bills, the other partner, who has very limited financial resources, maintains the household. Although they lack a marriage certificate, they present themselves as a committed couple.

But instead of creating estate planning documents, they simply promise to take care of one another during times of need, such as a serious illness or incapacity.

Then, the unthinkable happens. The one with the money - the partner with the assets to support their life together - becomes incapacitated. Those promises prove to be hollow when the dependent partner can't access funds to pay the bills.

The harsh reality is that a financial safety net in which one partner provides for the other doesn't exist. Couples can base relationships on promises and trust, but nothing carries the force of law like a marriage certificate.

“Just because you're living together doesn't mean you won't have to face the same financial decisions of couples that are married,” says financial adviser Dawn Doebler. “The difference is that you won't have the same legal protections they do. Couples who decide to live together should talk about financial issues, especially unpredictable events that could significantly impact their individual wealth. Sharing these plans with family members will help to avoid misunderstandings about who will take care of and pay for you or your partner as you age together.”

How can I protect my partner?

If unmarried couples with legitimate relationships want their partner to be able to make medical or financial decisions for them if they are incapacitated, they need to put it in writing.

Without an estate plan, statutory defaults will favor family members in determining who makes decisions on behalf of an incapacitated person. An unmarried partner will have no control. Without planning, the incapacity of one of the partners can lead to both unexpected and disastrous results. A dependent partner could be left without financial resources, a place to live and the ability to oversee medical care for their loved one.

What happens when my domestic partner is incapacitated?

If an incapacitated person lacks enforceable planning documents that name surrogate decision makers, a court-appointed guardian will be necessary.

In a guardianship proceeding, the judge has the final say over deciding who's in control of managing an incapacitated person's property and medical treatment. A judge will rely on a list of preferred individuals to act on behalf of an incapacitated person. A spouse leads the list, followed by blood relatives. An unmarried partner is not on the list. A judge, short of complete agreement of qualified family members, is highly unlikely to appoint a partner as an incapacitated person's guardian.

Unmarried couples need to take extra measures through legal tools to preserve control of their own affairs. With a timely power of attorney for health care, you can authorize your partner to make treatment decisions on your behalf. Other key documents are a HIPAA release that permits people you choose to access your private medical information and an advance health care directive (living will) that details your end-of-life treatment preferences.

A revocable living trust is the most comprehensive tool to accomplish that task. A trust can establish the same kinds of privileges for unmarried couples that married couples automatically enjoy. A trust can name a partner as successor trustee and spell out how specific assets can be distributed during the trustor's incapacity.

Family dynamics play a role in determining which estate planning tools are most likely to succeed in protecting the interests of your unmarried, dependent partner. Complications arise in blended family situations, especially when the wealthier spouse, who is incapacitated, has adult children from a previous marriage. They could seek guardianship and financial control if planning documents are not in place, and their disputes could lead to the appointment of a professional guardian.

As a result, a court-appointed guardian or disapproving family member could decide to discontinue financial support for the partner, putting them at risk.

To avoid those scenarios, the dependent partner could be named trustee and empowered to control the assets funded into the supportive partner's trust. Or, the dependent partner could be named as a beneficiary of the trust. The terms of the trust can be as detailed as necessary to meet the level of commitment the supportive partner desires.

Keep in mind, a dependent partner may not be best choice for successor trustee if other trust beneficiaries include the supportive partner's children from another marriage. A neutral third party might be a better option as a successor trustee. A power of attorney for finances would be required to establish control of assets held outside the trust.

Conclusion

In many cases, unmarried couples have an imbalance of assets in which one partner provides all or most of the financial support. If the wealthier partner becomes incapacitated, the dependent partner has no right to use the other's assets for ongoing living expenses. Legal tools, such as powers of attorney and a revocable living trust, can help ensure an incapacitated partner's assets can be used to maintain a dependent partner's lifestyle.