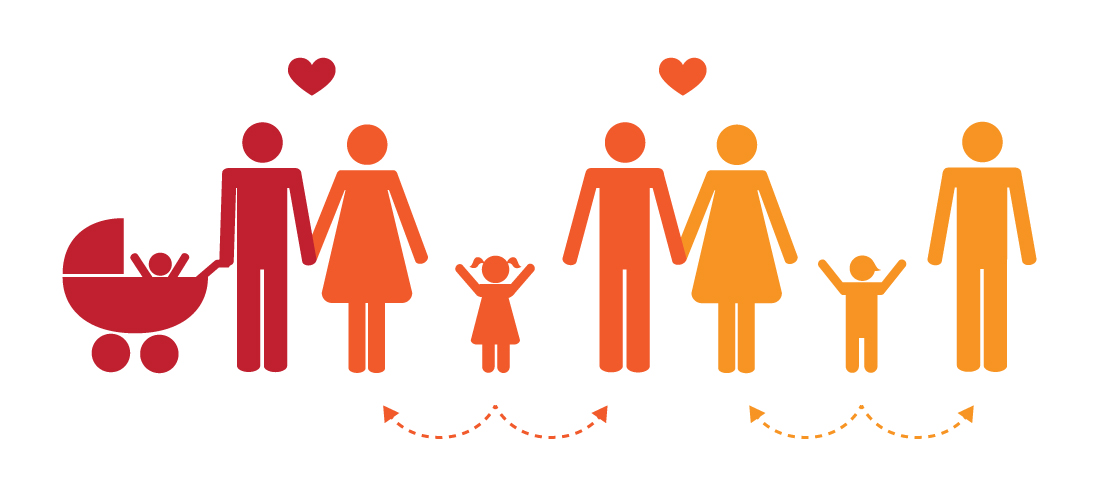

Estate planning is especially important for blended families - those families which include children from a previous marriage. State law does not account for children from previous marriages and relationships, which is why you must act now.

Estate planning is all about planning in advance for the management or distribution of your assets in the event of your death or incapacity. Your estate plan should provide you with peace of mind when you predetermine how your assets will be managed and who will be receiving a share.

Often, estate distribution follows a typical pattern. People commonly leave everything to their spouse and then equal shares to their children after their spouse's death. With a traditional family in which the married couple shares the same children, achieving this is quite simple. Yet, things tend to become more complicated when you have a blended family. Providing for children from a prior marriage or protecting inherited family property during your marriage will require careful advanced planning.

What is a blended family?

For estate planning purposes, a blended family is one that includes a child or children by someone other than your current spouse. Without proper planning, it is very easy to accidentally disinherit these children and run into other issues regarding inheritance. Since state legislatures created the intestate inheritance laws with a traditional family in mind, it's crucial to take time to plan in advance with the guidance of an estate planning attorney. If you fail to plan ahead, then your state intestacy laws will apply and will not take children from a prior marriage into consideration.

How to plan for a blended family

Inheritance

If you're someone who has or may inherit real property from family during your marriage, then you first must decide if you want your spouse to inherit this asset should you die first. If the answer is no, then it's crucial you keep this particular asset separate from the marriage. “Separate from the marriage” means that assessments, mortgage payments or any other payments are paid from a separate account that your spouse does not have access to and does not contribute to. Your spouse cannot contribute to improvements or take part in any other contributions. For some states, a trust is a helpful vehicle to hold the asset, but the asset must be transferred to the trust prior to the marriage and, again, no commingling of marital assets (so you must keep that separate account mentioned earlier with no contributions from your spouse). The laws regarding marital property differ significantly state by state, so always be sure to get advice from an attorney barred in your home state.

Children from a previous marriage

There are many ways in which you can make provisions for children from a previous relationship or marriage. You must be careful to plan properly, otherwise you could inadvertently disinherit them. Below are some popular options.

Beneficiary designations

These include pay-on-death or transfer-on-death designations for bank accounts and listing a beneficiary on other accounts. A beneficiary designation is a common and very basic estate planning tool utilized by many Americans. The best features when using this as your main planning device are the fact that it's free and relatively easy to set up. This approach will likely avoid probate, as well. One downside of using this approach is that you lose control over how the asset/funds will be managed. The distribution to the named beneficiary is outright, so you cannot prevent the beneficiary from making a bad decision and blowing their inheritance.

Although this is a way to provide for children from a prior marriage or relationship while still leaving asset to your spouse, it may not be the best option. If you have young children or an irresponsible child, you may not want to leave a lump sum of money outright to them. Another downside of using this option is that it does not provide your listed beneficiary with any creditor protection. Should they take this money and place it into their own bank account then get a divorce of their own or encounter a creditor issue, the money is at risk.

Lastly, you may inadvertently disinherit the listed beneficiary. For example, let's say you've created a will or trust. In your will or trust you leave 100% to your new spouse, but you're comfortable with this decision because you've listed your children from a prior marriage on a savings account as the primary beneficiary. If at the time of your death that savings account has been depleted, then your children will receive nothing from your estate.

Gifts of property

Another option is to make gifts to the child during your lifetime. The benefit of gifting assets during your lifetime include making a lasting memory with your child, knowing that they actually have received something from you and easily leaving the rest to your current spouse. The downside of utilizing this option might include capital gains, gift tax and watching your child not treat the asset as you would have (and knowing there isn't anything you can do about it).

Wills and trusts

The last will and testament is a great place to start with estate planning, although actually using this device to distribute your estate will require administration of your estate (i.e. probate administration). Many Americans wish to avoid the probate process since it is a lengthy, expensive, time-consuming and public process. A will does not provide any incapacity protection for you, creditor protection for your beneficiaries and does not allow you to have as much control from beyond the grave (when compared to a revocable living trust).

A revocable living trust is a popular estate planning tool since it provides easy probate avoidance, creditor protection for your beneficiaries (should you choose) and allows for you to control the estate distribution with more flexibility. When considering how to provide for both your current spouse and your children from a prior relationship or marriage, a trust can offer more than one option. For example, you can provide that a certain percentage goes to your surviving spouse and the remainder goes to your children (i.e. 80% to my spouse and 20% in equal shares to my children).

You can also create a trust so that your surviving spouse enjoys money during his or her lifetime with the remainder going to the children. Be cautious with this approach and speak with an attorney because if not drafted properly, the risk of the spouse depleting the assets still exists. If you wish for everything to go to your children and nothing to your current spouse, then you need to check state law to see if this is even possible. Florida, for example, only allows you to reduce the spousal share to the current elective share amount (currently this share is 30%). If you wanted to actually disinherit the spouse, you would need for them to sign a waiver of their elective share and likely a separate waiver regarding their homestead rights as well.

Even though it is very common for a married couple to leave everything to their surviving spouse, extra planning steps are required to ensure children from a prior relationship or marriage receive an inheritance. The same advanced planning is necessary to protect inherited assets received during the life of your marriage (to ensure that assets is considered marital property and subject to a potential later divorce).

The best plan of action to is to first consider what you own, where you want these assets to go (i.e. who are your named beneficiaries and what share will they receive) and what you feel might be the best option for how these assets will get to the listed beneficiaries (i.e. a will, trust or some other option previously discussed). Once you have your goals clear then make time to consult with an experienced attorney to ensure your goals are accomplished.