Members of the sandwich generation - typically those who provide support for their children as well as aging parents - are prone to financial hardships and a stressful existence. Experts say those in a caregiver role for multiple generations can take steps to ease the emotional and economic challenges.

If you are like millions of Americans, you could face a life-altering detour on your path to the American dream.

There's a decent chance that if you are middle-aged and have kids and aging parents, you'll wind up in the middle of the so-called “sandwich generation,” providing simultaneous support to the generations below and above you.

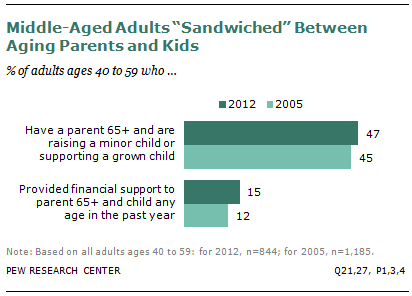

Almost half of Americans in their 40s and 50s share a common situation in life. They have a parent age 65 or older and are raising a youngster or financially supporting a grown child (18 or older) who may or may not still reside at home, according to a Pew Research Center study. Of those people in the middle generation, about one in seven - an estimated 20 million Americans - provides financial support at the same time to both an older parent or parents and a child or children.

“With an aging population and a generation of young adults struggling to achieve financial independence, the burdens and responsibilities of middle-aged Americans are increasing,” Pew's study found.

Those burdens aren't confined to finances and pull at both the family's purse strings and heartstrings, experts say.

“Not only do many provide care and financial support to their parents and their children, but nearly four in 10 (38%) say both their grown children and their parents rely on them for emotional support,” Pew says.

A MoneyTrack report describes the dynamic as a tug-of-war between time, love and money. “The everyday routine can feel like a game of beat the clock, squeezed between kids struggling to grow up and parents struggling to age with dignity,” the report says.

Filmmaker Julie Winokur and her husband, Ed, made an award-winning documentary in 2008, aptly titled “The Sandwich Generation,” which chronicles her family's experience after she and her husband and their two preteen kids moved across the country to live with and take care of her 83-year-old father with rapidly progressing dementia. Winokur simply describes her peers as “people who are taking care of their children taking care of their parents.”

Winokur's story exemplifies the enormous challenges facing all layers of the sandwich generation.

“We uprooted our lives and moved 3,000 miles in order to be there to support my father,” Winokur says. “It's like the primetime of my life, and I basically gave it away.”

The film depicts the double duties of Winokur and her husband as they tend to the kids' needs - breakfast, homework, a shoulder to cry on - and the needs of her aging father that encompass everything from dressing him to handling his finances and making health care decisions to simply using the remote control.

Their experience shows how aging parents can lose their sense of freedom and diminished personal pride over their inability to live independently. Another lesson: Children, meanwhile, may feel ignored or as if they are a burden themselves while those in the middle place their own retirement at risk.

What's the upside?

Despite the difficulties, there can be benefits. Perhaps it's simply the personal satisfaction of caring for a loved one. For Winokur's family, a huge blessing of their sandwich generation experience is the positive values instilled in the youngest generation.

“The kids are being given this life lesson in what it means to care for someone - what it means to come through for someone else,” says Winokur's husband.

“It's pretty cool having my grandpa in the house with us, but it's a little stressful for my parents,” says their grade-school age son.

“I will have no regrets when I look back on this, but darn, it's hard while you are in it,” Winokur says.

Studies support the anecdotal evidence found in Winokur's example. Despite the burdens and challenges those in the sandwich generation face, a 2018 Pew study found that caregivers cherish their roles. “The act of caring for an adult is often a very meaningful one for those who do it,” Pew found. “Caregivers rated about half of their caregiving experiences this way.”

How did we get here?

These days, not everyone will endure the challenges of the sandwich generation, but being stuck in the middle used to be a way of life for the majority of Americans.

Retirees began receiving Social Security benefits in 1940 - when the life expectancy was 60.8 years for men and 65.2 for women. Before then, “most elderly widows lived with one of their children - so common a practice that it developed a nostalgic sheen, enshrined as the way things ought to be,” according to a recent New York Times report.

A landmark study conducted for the National Institute of Aging in 2000 found that 18% of elderly widows lived alone in 1940, and that climbed to 62% by 1990. “Income growth, particularly increased Social Security benefits, was the single most important determinant of living arrangements, accounting for nearly one-half of the increase in independent living,” the study found.

The longevity of Americans has been on a steady rise over the decades, according to the Population Reference Bureau. The life expectancy of Americans since 1900 has increased from 47 to 79. Meanwhile, the U.S. population of people 65 and older is expected to double and reach 98 million by 2060.

Taking notice of this demographic trend was a scholar, not a food critic, who first coined the term “the sandwich generation” in a 1980 academic paper.

“Adult children of the elderly, who are 'sandwiched' between their aging parents and their own maturing children, are subjected to a great deal of stress,” University of Kentucky professor of social work Dorothy A. Miller wrote in the abstract to her 1980 study. “As a major resource and support for the elderly, this group has a need for the services that is only beginning to be met by the helping professions.”

In the meantime, if you've watched television over the past several decades, you'll find dozens of examples of the sandwich-generation theme. Popular culture provides many variations of the family dynamic in which middle-age people provide support to both younger and older generations. One could argue “The Waltons” family probably had it the worst, trying to make ends meet during the Depression, pinching pennies for John-Boy's education and coping with grandma's stroke and grandpa's unexpected death. In most sandwich generation scenarios - real and imagined - there's plenty of drama involved.

How to survive the sandwich generation?

So, what are some strategies if you have or may have the young, the old and you - the in-between generation - all under one roof? After all, in some cases, parents have depleted their retirement resources to pay for caregivers and now rely on you for financial and physical support.

With one in seven adults providing support to both an aging parent and a child, it makes saving for the college and retirement funds that much harder. Some actions to consider:

- Don't wait for a crisis. There are a lot of issues to address throughout life to prepare for a sandwich generation situation. Does the parent in need have adequate retirement savings or long-term care insurance? Can other siblings also participate in and contribute to the support system? “Don't wait until there is a health scare or a financial crisis to start having these conversations,” advises CNN's Christine Romans. “The needs of your loved ones are important, but so is your own financial future. So, talk openly and honestly with the people you love and don't put your own retirement at risk.”

- Get planning documents in order. Sandwiched family members should have powers of attorney for health care and finances for the people in their care as well as themselves. Medical release forms and advance directives (living wills) regarding end-of-life treatment decisions should be completed, and wills, trusts, beneficiary designations and other planning documents should be reviewed and updated. Also, professional legal and financial advice can help families navigate through a sea of paperwork and the complications involving Social Security benefits, Medicare, Medicaid and insurance coverage and claims.

- Get a support system. Friends, other families, neighbors and community organizations are a valuable resource that can reduce the vice-like pressure sometimes felt by those squeezed in the sandwich generation, the MoneyTrack report suggests. Consider including your employer as part of your support group. It may require explaining your situation to your boss if you anticipate needing time off or other considerations because of your caregiving obligations.

- Provide assistance where it's truly needed. Romans suggests establishing some important “boundaries.” For example, children in the home are one thing; 30-year-old gamers in the basement are another. If finances are tight, “whatever you do, don't make living at home too comfortable for them - you are not running a bed and breakfast,” she advises. “Find ways for them to contribute financially.”

What are the biggest challenges?

-

It's a financial drain

Family caregivers spent about 20% of their income in 2016 toward the care of loved ones, according to an AARP study. For lower-income folks, the out-of-pocket costs consumed closer to 44 percent of their wages. “Family caregivers report dipping into savings, cutting back on personal spending, saving less for retirement or taking out loans to make ends meet. More than half of family caregivers reported a work-related strain, such as having to take unpaid time off,” the study says.

-

The denial of reality

Stress is another huge problem for those in the sandwich generation, but there are ways to address the anxieties, says gerontologist Amy O'Rourke in a Ted Talk presentation on the subject. “We are afraid of endings,” O'Rourke says. “We are scared of seeing our parents get smaller, more diminished - shaky judgment, walking slower. We are scared, and we deny it. We pretend it's not there; we don't want to face it.” A failure to accept the decreasing ability of older people to care for themselves causes stress for all those involved, she says.

-

You can't go backwards

Aging is a one-way transition, O'Rourke advises. “Kids want the parents to go backwards. They want them to go back to where they were, and they miss where they are.” Don't expect an aging parent to stay the same, and realize that the aging process is not reversible, she says. “The most important thing is to be there.” Another piece of advice: Do not consider caring for an aging parent as a role reversal. “We never become our parents' parents, and if you try, you won't do so well,” and don't expect an elderly parent to suddenly enjoy being bossed around, she warns. “You are responsible for them, but you should work on a way of communicating to help them manage this time of life without insulting them and telling them what to do. And it takes some work.”

-

It's going to be a lifestyle change

As parents age and require some level of care, your responsibility begins - whether or not they live in the same town as you, O'Rourke says. Those who accept their responsibility as a caregiver will have less stress than those who don't, she observes. O'Rourke relates a little-known story about the tough decision Condoleezza Rice faced when she was offered the position of secretary of state. “She almost turned that job down. You know why? Because her father had a stroke, and she didn't know if she could do that job and take care of her father.” Rice felt her first responsibility was to her aging parent and only accepted the post once she was assured his needs would be met, O'Rourke said.