Unmarried couples may be partners for life, but in legal terms they are complete strangers. Courts, financial institutions and doctors are not automatically required to follow a life partner's wishes. Instead, they are bound by default statutes on inheritance, health care and property rights that often conflict with the unmarried partners' intentions. Additional complications arise for unmarried couples regarding parental rights. By using the proper life and estate planning tools, however, unmarried couples can establish the same kinds of rights and relationships that marriage provides.

Estate planning is critical for everyone, but even more so for unmarried partners.

Ask June Schroeder. Schroeder knew that her widowed aunt's intentions were to leave her estate to her life partner of the past many years.

But her aunt died without a will, a trust or other estate planning documents.

“I know her intentions were to leave her assets, including their home, to her life partner. But she never did the paperwork,” June told Forbes.

As a result, her aunt's partner never received a dime. She was forced to vacate the home they shared as an unmarried couple. Nieces and nephews (the aunt's closest survivors) inherited the estate according to default statutes on inheritance.

“All the funds were eventually disbursed to 11 others after time spent gathering death certificates and piling up legal fees,” June said.

Her aunt and her life partner lacked a plan, and the consequences were heartbreaking.

In the case of Sara Watson and her partner, Anna Borman of Rhode Island, reproductive technology enabled them to have a healthy baby boy.

| Unmarried Partners Need a Comprehensive Estate Plan | |||||

|---|---|---|---|---|---|

| Problems Facing Unmarried Partners Without a Plan | Planning Solution | ||||

| Will | Trust | Powers of Attorney for health, finances | Advance Directive (Living Will) | Beneficiary Designations, deeds, etc. | |

| Partners are not heirs at law | |||||

| Partners lack authority to make emergency medical decisions for each other | |||||

| Partners are not the automatic primary beneficiary of retirement accounts | |||||

| Partners have no right to remain in home owned by other partner at their passing | |||||

| Partners are not on preference list to serve as guardian of non-spouse | |||||

| Partners are not on preference list to serve as guardian of other partner's children | |||||

| Children don't have right to inherit from non-biologic parent | |||||

A few days later, the unmarried couple got the bad news.

Sara could not be listed as a parent on the birth certificate in their state - the form included a line for one mother and one father. Their joy turned to distress.

Sara discovered she had no legal ties to a child created from her own donated egg using in vitro fertilization. State law assumes that parents are a man and woman - not an unmarried, same-sex partnership.

Panic turned to legal action, and it took eight months to complete a formal adoption through the courts. In the meantime, Sara was required by the day care to obtain written permission from Anna to pick up their child - legally recognized as Anna's child alone. There were other unexpected problems. Sara couldn't add the boy to her life insurance policy. Should anything happen to her partner, Sara would have no custody rights to the child or no ability to act on her partner's behalf if she became incapacitated or died.

Much to Sara's dismay, she had no more rights to care for the child than a stranger on the street. They described the whole process as “degrading.”

Why are unmarried couples at a disadvantage?

Spouses have legal rights that unmarried partners don't. In the eyes of the law, the duration of a relationship or your degree of devotion do not matter. Just living together doesn't give you the same spousal rights that marriage does. Cohabitation does not qualify as a legal union. Unfortunately, many people assume that living and outwardly behaving like a married couple equates to a “common-law” marriage. They mistakenly think that sharing a roof year after year entitles them to the same inheritance rights, decision-making privileges, parental rights, statutory protections and financial advantages as their ring-exchanging peers.

Children make matters even more complicated when the partners' presumptions and the law's definition of “children” don't match. An unmarried partner has no custody rights to the other partner's children, regardless if they live together as a family. When couples have children out of wedlock, they can't assume both parents will be listed on the birth certificate. A father who is unmarried when his child is born, for example, must sign an official acknowledgement of paternity or similar document, along with the mother, to establish parental rights.

Same-sex partners also face additional challenges regarding parental rights over issues related to reproductive technology and qualifying as a “blood” relative.

When incapacity or terminal illness strikes, an unmarried partner, unlike a spouse, is left off the preference list to serve as the other's guardian. An unmarried person also lacks standing to make end-of-life health care decisions on a partner's behalf.

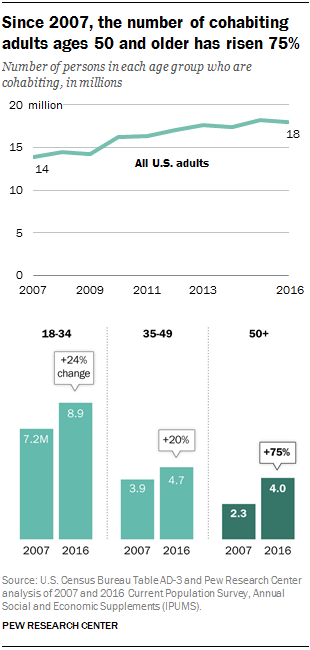

Meanwhile, more and more people are choosing to live together without the formalities of marriage. The number of unmarried partners has reached historic levels and is trending upward. A Pew Research Center study found that from 2007 to 2016, the number of cohabitating adults in America climbed 29% from 14 million to 18 million.

What risks do unmarried partners face?

For couples, the statutory defaults on inheritance, health care, property rights and parenthood are based on a relationship formalized by marriage. Those statutes follow the typical preferences of a married couple in which they share property, inherit from one another, serve as each other's surrogate decision-maker and share responsibility for children. Here are some of the challenges unmarried partners face:

- Unmarried partners are not heirs at law. Because of state intestacy laws, which are followed by default when there's no will or trust, unmarried partners face the prospect of inadvertently disinheriting each other. Intestacy laws establish a hierarchy of blood relatives based on the family tree to distribute your assets, and your unmarried partner is excluded. Instead of your partner, your assets go to a nephew you never met.

- Unmarried partners lack authority to make emergency medical decisions for each other. By default, married partners have the right to act on behalf of their spouse in the event of incapacity. If there's no legal spouse, doctors look to immediate family members or a court-appointed guardian for instruction, not your partner of 10 years.

- Unmarried partners aren't the automatic primary beneficiary of retirement accounts. A married partner is the default beneficiary of a retirement account after the owner's death. With no named beneficiary, the retirement account goes to your probate estate, not an unmarried partner.

- Unmarried partners have no right to remain in home owned by other partner at their passing. With no homestead rights like a spouse, a surviving partner would be forced to move from the residence they shared but did not jointly own. An heir at law typically sells the inherited asset without regard to the surviving partner.

- Unmarried partners are not on preference list to serve as guardian of non-spouse. From a court's perspective, a blood relative or professional guardian is preferred over an unrelated person. An unmarried partner would need to petition the court to make medical and financial decisions for their partner in a time of need. Also, a public court hearing can be exploited, for example, as an opportunity for those opposed to a same-sex relationship to intervene.

- Unmarried partners are not on preference list to serve as guardian of other partner's children. Only natural or adoptive parents have legal rights to the other partner's children. A former spouse or the other natural parent would be on the preference list, not an unmarried partner.

- Children don't have right to inherit from a non-biological parent. A non-biological child must be adopted by the unmarried partner for a formal parental relationship to exist. By default, actual heirs at law would stand to inherit from a person who has not established paternity.

How can unmarried couples avoid obstacles?

To receive similar treatment as married couples, unmarried partners need to create a comprehensive estate plan. You need to be diligent in planning to ensure your assets are distributed as you choose after your passing. Parental rights need to be established. Property rights need to be addressed. And unmarried couples need to plan so they can take care of one another's finances and health care in times of need.

By using the proper life and estate planning tools, unmarried couples can establish the same kinds of rights and protections that marriage provides, and they can leave behind the legacies they want for the loved ones and beneficiaries of their choosing.

-

Establish inheritance rights.

Spouses have automatic inheritance rights; unmarried partners don't. Through your last will and testament and revocable living trust, you can ensure your unmarried spouse will not be disinherited. You have control over your trust's assets during your lifetime, and your unmarried partner can serve as successor trustee and carry out your distribution wishes. You avoid default intestacy laws that don't take unmarried couples or non-biological children into consideration. Distributions in your will that are contrary to statutory defaults can be problematic and exposed to challenges from would-be heirs. Trusts, unlike wills, bypass probate, are private documents and face less exposure to outside interference.

-

Choose your preferred surrogate decision-maker.

With a power of attorney for health care, you can give an unmarried partner the legal authority to make decisions about your health care and living arrangements if you become incapacitated. If you fail to name a health care agent, a judge could appoint a professional guardian to act for you. With a financial power of attorney and successor trustee, you can name an unmarried partner to manage your assets. An advance directive for health care (living will) can authorize your surrogate decision-maker to be involved inyour end-of-life care. When you have powers of attorney and a successor trustee, you can avoid an unplanned guardianship.

-

Name beneficiaries for retirement, other accounts.

Unmarried partners can avoid probate and default distributions by using beneficiary designations. Bank, brokerage and retirement accounts and life insurance policies, for example, can specify beneficiaries. Spouses, not unmarried partners, have rights to inherit pensions and Social Security benefits. Also, some companies may prohibit the transfer of pensions or retirement accounts to non-spouses.

-

Make sure your surviving partner has a homestead.

An unmarried partner has no legal right to remain in a home owned by the other partner at their passing. Unmarried couples can consider shared ownership of property. A deed that reflects ownership as joint tenants with rights of survivorship is an option unmarried couples choose to ensure the real property they share passes to the surviving partner and avoids probate. In some states, transfer-on-death and life estate deeds are available. Titling real property in the name of a revocable living trust is another way to avoid probate and distribute a home or protect a homestead for an unmarried partner.

-

Name a guardian for minor children.

You can only name a guardian for your minor children if you have established paternity naturally or through adoption. Your will only suggests a guardian on your death, but a trust enables you to provide support through your successor trustee if you become incapacitated as well as after death. With a will and trust in place and paternity established, partners can reduce the risk of an unwanted person or institution or institution serving as a child's guardian.

-

Address issues unique to same-sex partners.

A will alone is rarely the best solution for same-sex partners. Experts say same-sex partners commonly are susceptible to disapproving family members who are apt to contest wills and file guardianship petitions. Also, assumptions about maternity and paternity are based on traditional marriage and fail to consider reproductive technology that enables same-sex couples to have children together through surrogacy and sperm donation techniques. State laws vary on the requirements to establish or relinquish parental rights for surrogates and sperm and egg donors.