New year's resolutions are easily broken and rarely become reality. Most resolutions are impractical and abandoned within a month or two. To be successful, resolutions require a strong desire and disciplined motivation. While we tend to focus on health and finances after the first of the year, dedication to family is the top overall priority for most Americans. A resolution to protect yourself and your loved ones through comprehensive estate planning is a realistic objective to consider.

By the time corks fly and calendars flip, less than half of Americans will have resolved to make changes for the better as they begin 2019.

About half of us will make a new year's resolution, and the rest won't bother, recent polls say. An estimated 90% of those who've made a resolution will have broken it by Jan. 15, and a Forbes report says 80% of those early-January aspirations will be abandoned entirely by February.

Those who vow to improve their lot in life tend to find that new year's resolutions can be daunting when they set unrealistic goals and overly lofty expectations. It can be impossible to make a resolution become reality, especially if you choose the wrong objective.

Blown budgets make us resolve to spend less and save more. Those Thanksgiving and Christmas feasts inspire us to cut calories and exercise. As a result, health and fitness and finances have become leading contenders on the list of resolutions. Suddenly, we're motivated to explore automatic savings account transfers and the latest smartwatches that count every step we take.

Do you have practical expectations?

Experts agree that if you want to turn your new year's resolutions into reality, make them practical and achievable. Don't try to accomplish too much, they say. Keep them simple. Be patient. Don't expect perfection. And seek help and encouragement from family, friends, faith and other resources.

Keep in mind that to break a habit, it can take two months of daily diligence, according to a University College London study. Persistence and dedication are key ingredients to success, experts say.

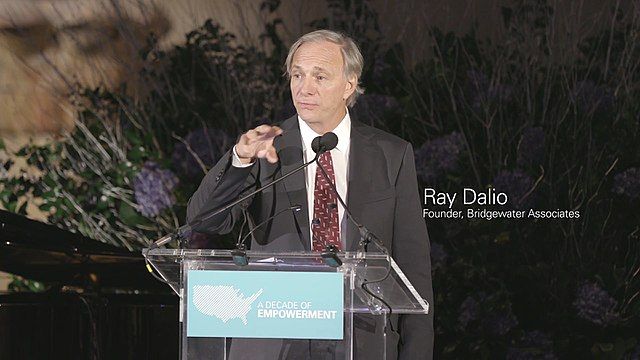

Your resolution is more likely to succeed if you pick quality over quantity, suggests investor, philanthropist and Bridewater Associates founder Ray Dalio. He urges those who plan to make a new year's resolution "to identify what your "one big thing" is and deal with it."

"Everyone has weaknesses and they are generally revealed in the patterns of mistakes they make," Dalio writes in his 2017 autobiography, Principles:Life and Work. "The fastest path to success starts with knowing what your weaknesses are and staring hard at them. … The first step to tackling these impediments is getting them out into the open."

For Dalio, it's OK to focus on a single significant shortcoming. If so, you're likely to knock down the obstacles you confront in life.

"Make it your mission to effectively deal with your 'one big thing' in the next year. By having identified it and by constantly keeping it in mind so that it annoys you like a pebble in your shoe, you will find that you will naturally reduce it as a barrier. And by reducing it as a barrier, you will radically improve your life. Then you can go on to the next big challenge or the one after that."

Are you in the right mindset?

So by the time February rolls around, why do many of us find that getting in shape, kicking a habit, saving money or other resolutions seem out of reach?

"As the saying goes, it's not the horse that draws the cart, it's the oats. It's not the gym, Pilates class or diet that will change you - it's your mind," says a U.S. News and World Report article that ponders the annual challenges we create for ourselves.

The way to succeed is found above the shoulders and between the ears, agrees renowned life coach and author Tony Robbins. Unless you are vested in your resolution, he says, you'll likely shrug your shoulders and try again next year, maybe.

"It's like the old adage, 'If you want to take the island, you burn the boats,'" Robbins says. "Because, when you burn those boats, there's no going back. You're going to find a way to make things work."

Robbins provides the following pointers to avoid a detour on the road to your resolutions.

- Back your resolutions with a strong desire - Think of the obsessions you may have felt in the past - for a new car, a coveted job or a magical relationship. Pursue your resolution with the same passion, excitement and energy.

- Focus the intensity of your emotion - If you keep at it daily, you'll get to the point where the resolution or goal becomes hard-wired in one's mind. "When you really get clear and it's compelling and you are reviewing it every day and have strong reasons to review it every day and are feeling it, the brain becomes incredibly acute at noticing anything to get you to move forward," he says.

- Raise your standards - Make a resolution a "must" and not a "should." Says Robbins: "If you identify yourself in a new way and you own that every day and that becomes the standard of how you live, you will find a way to make that standard real."

- Follow up with a ritual - "Rituals define us. All the results in your life are coming from your rituals. They start with a standard, and the rituals follow it up. For example, if you are where you want to be physically, you have very different rituals than if you are not where you want to be physically," he says. If your standard is to be healthy and strong, your ritual should be to eat well and exercise. Persistence will pay off, and you'll gain momentum every day. "Discipline weighs ounces; regret weighs tons."

Have you resolved to protect your family?

It's no surprise, but most Americans surveyed say the meaning in life is found in their obligation to family, followed by careers and money.

"The most popular answer is clear and consistent: Americans are most likely to mention family when asked what makes life meaningful … and they are most likely to report that they find 'a great deal' of meaning in spending time with family," a Pew Research Center study found. Also, one-third of Americans surveyed mentioned children or grandchildren when describing what makes life feel meaningful. Children and grandchildren were the most commonly mentioned specific aspects of family.

Meanwhile when it comes to resolutions, Americans still prefer to take better care of their bodies and their bank accounts - especially in the wake of the holidays.

"The top resolutions among American adults all revolve around two main themes: health and money," a Harris Poll found. "Most commonly, adults are resolving to eat healthier (29%), save more money (25%), lose weight (24%), drink more water (21%), and/or pay down debt (17%)."

Despite concerns over health and money, only 42 percent of adults have some estate planning documents in place, such as a last will and testament or revocable living trust, to protect themselves and their families, according to a Caring.com survey. What's worse, the percentage is lower (36%) for parents of children under the age of 18, leaving the kids without a predetermined guardian should the need arise. A still smaller percentage of the adult population has a comprehensive plan with a host of other critical documents, including powers of attorney for health and finances, an advance directive for health care, HIPAA waivers, instructions for digital assets and others.

Family is a top priority for most folks, and there's a natural desire to be prepared for the life-changing events that may come our way - the addition of a new child, an unexpected serious illness, a marriage or divorce, the tragic loss of a loved one, or our own potential misfortunes.

Nevertheless, many of us remain unprepared.

"I think many Americans avoid setting up a will because they simply don't want to think about their death," Texas-based financial coach Craig Dacy told Caring.com. "However, setting up a will not only takes care of your loved ones financially, it can save them a lot of emotional stress after you're gone."

A lack of resolve is the leading excuse given by those who've failed to address estate planning obligations. The survey found that 47% or respondents said they "hadn't gotten around to it."

That's unfortunate, because without a comprehensive plan, you have a lack of control and a weak link connecting you to your family's future. If you care about your family but lack a comprehensive plan, you'll likely start the year with a so-called "pebble in your shoe."

"This is the 'I'm going to live forever' theory. No one literally thinks that, but we all want to believe we are going to live until our 80s or 90s, so we don't think we need a will right now," says Debbi King, author of The ABC's of Personal Finance, told Caring.com. "This isn't true, of course. We all have an expiration date, and no one knows exactly when it will be. The best thing you can do for your loved ones is have a will now."

Over the recent Thanksgiving and Christmas holidays, you've likely spent a good deal of time with loved ones and have the latest information on the family's long-term needs. If estate planning is that "one big thing" you wish to address this year, you've got a head start.

A good place to begin your estate planning quest is with a checklist. Do you and your spouse have wills? Have you nominated guardians for minor children if needed? How about a living will that addresses end-of-life preferences for health care? Do you have a revocable living trust to protect your assets and beneficiaries from the lack of privacy, expense and delays of probate? Are powers of attorney in place to look out for your health and financial interests in the event of your incapacity? Membership with Legacy Assurance Plan enables consumers to accomplish their estate planning mission with the guidance of network attorneys and financial professionals.

As the years pass, family circumstances change, so it's a good idea to resolve to review your documents annually and update them when necessary. In doing so, you'll have peace of mind knowing the paperwork is in place to protect you, your loved ones and your eventual beneficiaries.

"Remember that weaknesses don't matter if you find solutions," Dalio says.

And those solutions begin with commitment, Robbins says. "Setting goals is the first step in turning the invisible into the visible."