People often overlook sentimental assets during estate planning, but this oversight can lead to relationship-ending fights and costly litigation. Instead, you should carefully consider property of high emotional value and provide clear instructions for its distribution in your estate plan.

When Robin Williams tragically died in 2015, a bitter estate battle broke out between Williams' wife and his children from previous marriages. Shockingly, the center of the dispute wasn't money but rather the tuxedo Williams wore at his wedding and 60th birthday party. Despite the existence of a detailed trust, the tuxedo and other personal property with sentimental value were not explicitly addressed. The family ended up in a public, costly and highly contentious fight.

The story of Robin Williams' estate is not an anomaly. Although often overlooked during estate planning, personal property with sentimental value is a frequent cause of estate disputes. These fights can be long-lasting and end up tearing families apart.

Why are sentimental assets different?

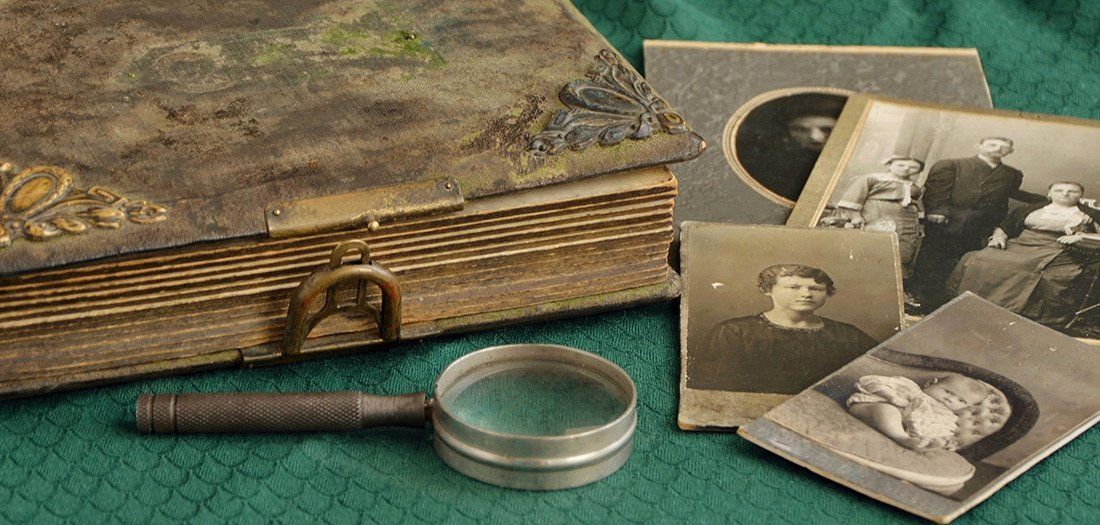

Items with a high sentimental value, such as jewelry, antiques, photographs, clothing, furniture and collections, are pieces valuable not for their financial worth but because of the memories attached to them. Unlike other property, emotionally valuable assets cannot be easily divided. Your children can equally split the money in a bank account, but they cannot divide your grandmother's favorite apron in half. When disputes over property with high emotional value do occur, legal fees and court costs often exceed the financial value of the item.

Should I discuss sentimental property with my family before estate planning?

Before you create your estate plan, it is helpful to sit down with your family and discuss how you are planning to distribute your personal property. Often, you may be unaware of the value that family members attach to specific items. This information can help guide you as you decide who should receive each piece of property.

This discussion will also give you the chance to explain why and how you made your decisions. Though it may seem uncomfortable, it will significantly reduce the likelihood of disagreements after your death. In addition to staving off fights, you will have the opportunity to elaborate on the history and story behind the pieces, giving them even more value.

Should I distribute sentimental property during life or after death?

One way to avoid fights after your death is to give property away during your lifetime. There are two primary benefits of lifetime gifting. First, you avoid having to include the items in your estate plan and can rest assured that the property is being distributed as you intend. Secondly, if the item is also of financial value, there could be tax benefits. In general, lifetime gifts are subject to a gift tax. However, up to $15,000 may be gifted from one person to another annually without triggering the tax. This allows you to gift the property tax-free and, at the same time, reduce the value of your estate.

What are the different methods of distributing sentimental property through estate planning?

There are three primary ways to tackle the distribution of property with emotional value in your estate plan:

- Listing each piece of property and its beneficiary in your will or trust.

- Listing each piece of property and its beneficiary in a personal property memorandum.

- Creating rules or guidelines for the distribution of the property.

Each method has its advantages and disadvantages. You should speak with a professional to decide which is best for you.

How do I use a will to distribute sentimental property?

The first method of distributing sentimental personal property is to list the items and the intended beneficiaries in your will. It is important to specifically address the property and avoid being vague. The more precise your will, the less likely there is to be a dispute.

The two major disadvantages of including a list of the property in your will are that it's difficult to amend and it becomes part of the public record. Each state has its own requirements for amending wills, which may include witnesses and notaries. Every time you wish to add an additional piece of property or change the beneficiaries, you must comply with the formalities, or the changes will not be valid. Additionally, as part of the probate process, a will becomes part of the public record. If you want to keep the list of your property and who it is being bequeathed to private, including it as part of your will may not be the best option.

How do I use a personal property memorandum to distribute sentimental property?

The second method of distributing property with emotional value is to create a personal property memorandum. A personal property memorandum is a document separate from a will that allows you to make gifts of tangible property such as jewelry, collectibles, antiques, artwork, clothing and furniture (not money or real estate). It lists the property and the person you wish to gift it to.

Because the memorandum is a separate document from the will, it is not necessary to go through the same formalities when updating the list. It is easy to add or delete property or change the beneficiaries. It can be updated as often as the testator desires.

Not every state recognizes personal property memorandums as legally enforceable. The following 29 states will enforce a personal property memorandum:

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Delaware

- Florida

- Hawaii

- Idaho

- Indiana

- Iowa

- Kansas

- Massachusetts

- Michigan

- Minnesota

- Missouri

- Montana

- Nebraska

- Nevada

- New Jersey

- New Mexico

- North Dakota

- South Carolina

- South Dakota

- Utah

- Virginia

- Washington

- Wisconsin

- Wyoming

How do I create rules in my will or trust for dividing personal property?

A third option for distributing your personal property of sentimental value is to include guidelines for how it should be distributed in your will or trust. There are several different methods that you can choose. Some examples include:

- Drawing lots and taking turns choosing items. After each round, lots are redrawn, so the order is continually changing.

- Holding a private auction. Each heir has the opportunity to bid for the item in a private auction, and payment goes to the estate.

- Taking turns in birth order.