ASSET PROTECTION STRATEGIES

Safeguard Your Wealth and Estate

Asset protection strategies can address creditors, lawsuits and financial threats. Protect your estate and family's financial future.

Asset Protection : Strategies

to Safeguard Your Estate

Asset protection represents one of the most critical aspects of comprehensive estate planning, serving as your first line of defense against potential threats to what you own. In today's increasingly litigious society, protecting your assets from creditors, lawsuits, and unforeseen financial challenges has become essential for maintaining long-term financial security.

Asset protection encompasses a range of legal strategies and structures designed to shield your assets from potential claims while ensuring your assets remain available for your intended beneficiaries. These protective measures work within the bounds of existing laws to create barriers between your wealth and those who might seek to claim it through legal proceedings or creditor actions.

Understanding Asset Protection Fundamentals

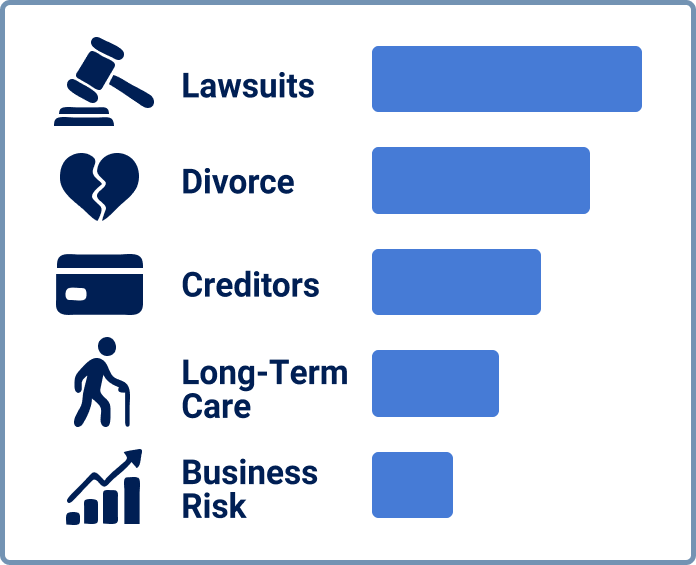

The foundation of effective asset protection lies in understanding the various threats your wealth may face throughout your lifetime. Common risks include professional liability claims, business-related lawsuits, divorce proceedings, and unexpected creditor actions. By implementing proper asset protection strategies early, you create a protective framework that can withstand these challenges while preserving your financial legacy.

Modern asset protection planning goes beyond simple ownership transfers. It involves sophisticated legal structures that maintain your access to assets while creating legitimate obstacles for potential creditors. These strategies must be implemented before any threats materialize, as courts generally view post-litigation transfers as fraudulent conveyances.

The most effective asset protection plans combine multiple strategies tailored to your specific circumstances, risk profile, and financial objectives. This layered approach ensures comprehensive coverage while maintaining flexibility as your situation evolves over time.

Common Threats to Wealth

Critical Reasons for Asset Protection Planning

Beyond traditional liability concerns, several specific circumstances make asset protection planning essential for protecting your estate and beneficiaries. Understanding these situations helps you recognize when specialized protection strategies become necessary for your family's long-term security.

Medicaid Eligibility and Estate Recovery concerns affect millions of families facing long-term care costs. Medicaid's look-back period examines asset transfers made within five years of applying for benefits, potentially disqualifying applicants who haven't planned properly. Even more concerning, Medicaid estate recovery programs allow states to reclaim benefits paid by placing liens on homes and other assets after death. Proper asset protection planning can help preserve eligibility while protecting family assets from recovery claims.

Spendthrift Beneficiaries present unique challenges for estate planning. When beneficiaries struggle with money management, poor financial decisions, or gambling problems, direct inheritances can disappear quickly. Asset protection trusts with spendthrift provisions prevent beneficiaries from pledging future distributions as collateral and protect inheritances from their creditors. These trusts ensure your legacy provides long-term security rather than short-term spending opportunities.

Substance Abuse Issues among beneficiaries require specialized asset protection approaches. Direct inheritances to individuals with addiction problems often fuel destructive behaviors rather than providing financial security. Discretionary trusts allow trustees to withhold distributions when substance abuse concerns exist while providing for legitimate needs like housing, education, and healthcare. This protection ensures your wealth supports recovery rather than enabling continued addiction.

Special Needs Beneficiaries face the risk of losing government benefits if they inherit assets directly. Supplemental needs trusts (also called special needs trusts) preserve eligibility for Medicaid, SSI, and other means-tested programs while providing enhanced quality of life. These specialized trusts can pay for items and services not covered by government programs without jeopardizing essential benefits that provide for basic care needs.

High-Risk Professions create ongoing liability exposure that standard insurance may not fully cover. Healthcare providers face malpractice claims that can exceed policy limits. Business owners encounter product liability, employment claims, and partnership disputes. Real estate professionals deal with disclosure issues and transaction problems. Financial advisors face fiduciary liability and regulatory actions. These professions need layered asset protection strategies that go beyond professional liability insurance to protect personal wealth from business and professional risks.

Business Asset Protection

Business owners face unique asset protection challenges requiring specialized strategies. Corporate structures, when properly maintained, provide liability protection by separating business and personal assets. However, inadequate capitalization or failure to observe corporate formalities can pierce this protective veil.

Professional practices require tailored asset protection approaches due to increased liability exposure. Combining professional liability insurance with appropriate business structures and personal asset protection strategies creates comprehensive coverage for healthcare providers, attorneys, and other professionals.

Multi-entity structures allow business owners to segregate different aspects of their operations, limiting exposure from any single business activity. This approach proves particularly valuable for real estate investors and businesses with multiple revenue streams.

Frequently Asked Questions About Asset Protection

Q: What is asset protection and why do I need it?

Asset protection involves legal strategies designed to shield your wealth from potential creditors, lawsuits, and other financial threats. Everyone needs asset protection because anyone can face unexpected claims, whether from business liabilities, professional risks, or personal circumstances.

Q: When should I implement asset protection strategies?

Asset protection must be implemented before any threats arise. Courts view transfers made after litigation begins as fraudulent conveyances. The best time is when you have no known creditors or pending legal issues.

Q: Are asset protection strategies only for wealthy individuals?

No, asset protection benefits anyone with assets worth protecting. Whether you own a home, run a business, or have retirement savings, proper protection strategies can safeguard what you've worked to build for your family's benefit.

Q: What's the difference between domestic and offshore asset protection?

Domestic asset protection uses structures within the United States, like domestic asset protection trusts and LLCs. Offshore protection places assets in foreign jurisdictions with stronger asset protection laws, providing additional layers of security but requiring more complex planning.

Q: Can I maintain control over protected assets?

Yes, with proper planning. Effective asset protection strategies balance protection with reasonable access. Discretionary trusts and properly structured entities can provide protection while allowing you to benefit from your assets under appropriate circumstances.

Q: How does insurance fit into asset protection planning?

Insurance serves as the first line of defense against claims. Professional liability, umbrella policies, and other coverage protect against common threats. When combined with other strategies, insurance creates comprehensive protection layers.

Q: What if my beneficiaries have substance abuse or spending problems?

Discretionary trusts with spendthrift provisions protect inheritances from beneficiaries' poor decisions and creditors. Trustees can withhold distributions when substance abuse concerns exist while still providing for legitimate needs like housing, healthcare, and education.

Q: Do I need special planning for a disabled beneficiary?

Yes, special needs trusts (supplemental needs trusts) preserve government benefit eligibility while enhancing quality of life. These trusts can pay for extras not covered by Medicaid or SSI without jeopardizing essential benefits that provide basic care.