LONG-TERM CARE PLANNING

Protecting Your Future and Family Assets

Comprehensive long-term care planning strategies to protect your assets and ensure quality care. Learn about insurance options, costs, and estate planning solutions.

Long-term care represents one of the most significant financial challenges facing American families today. With health care costs continuing to rise and life expectancy increasing, planning for potential long-term care needs has become essential for protecting both your financial security and your family's future.

Understanding Long-Term Care Needs

Long-term care encompasses a wide range of services designed to help individuals who cannot perform basic daily activities independently. This care extends far beyond traditional medical treatment, including assistance with:

- Bathing and personal hygiene

- Dressing and grooming

- Eating and meal preparation

- Mobility and transfers

- Medication management

- Transportation to appointments

The statistics surrounding long-term care needs are compelling. Studies show 70% of people over age 65 will require some form of long-term care during their lifetime. This care might be needed for just a few months or could extend for several years, making financial planning crucial for maintaining quality of life and preserving family assets.

The True Cost of Long-Term Care

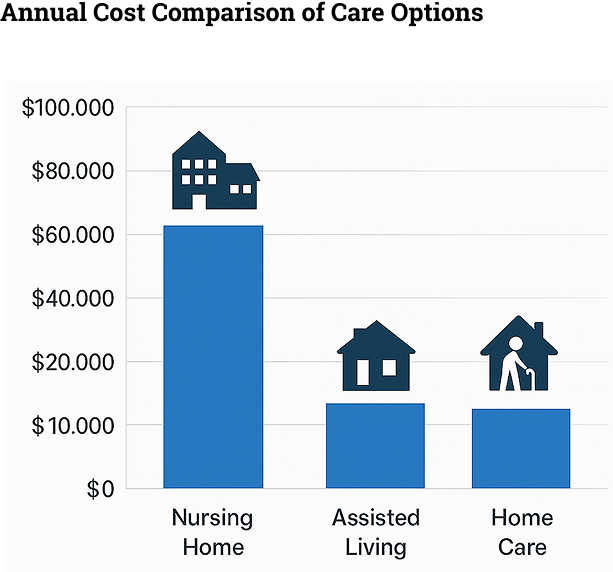

Understanding the financial impact of long-term care is the first step in effective planning. The costs vary significantly based on the type and location of care needed.

Nursing home care represents the most expensive option, with national average costs exceeding $100,000 annually for a private room. Even in lower-cost regions, families can expect to pay substantial amounts for quality facility-based care. These costs continue to rise faster than general inflation, making early planning even more critical.

Home-based care, while often preferred by individuals and families, also carries significant expenses. Professional in-home care services can cost $25-50 per hour depending on the level of care required and geographic location. For individuals requiring extensive daily assistance, these costs can quickly approach or exceed nursing home expenses.

Assisted living facilities offer a middle ground between independent living and full nursing care, with average costs ranging from $3,000 to $6,000 monthly. These facilities provide personal care assistance while allowing residents to maintain some independence in a community setting.

Insurance Solutions for Long-Term Care

Long-term care insurance serves as a primary tool for managing these substantial costs. Traditional long-term care insurance policies provide coverage specifically designed to pay for various types of long-term care services.

These policies typically offer daily benefit amounts that can be applied toward various care settings. Key policy features include:

- Daily benefit amounts ranging from $100 to $500 or more

- Coverage duration options from 2 years to lifetime benefits

- Elimination periods (waiting periods) before benefits begin

- Inflation protection riders to maintain purchasing power

- Premium costs based on age, health, and benefit selections

Hybrid life insurance policies with long-term care riders have gained popularity as an alternative approach. These products combine life insurance with long-term care benefits, providing value whether or not long-term care is needed. If care becomes necessary, the policy pays benefits to cover expenses. If care is never needed, beneficiaries receive the death benefit.

Medicare and Long-Term Care Limitations

Many people mistakenly believe Medicare will cover their long-term care needs. However, Medicare provides only limited coverage for long-term care services under specific circumstances.

Medicare covers skilled nursing facility care only following a qualifying hospital stay and only for a limited time period. The coverage applies specifically to skilled medical care, not custodial care that most long-term care residents require. After the initial coverage period, individuals become responsible for the full cost of care.

Similarly, Medicare home health benefits require specific medical conditions and provide only intermittent skilled care rather than the continuous personal care assistance most people need for daily activities.

Medicaid Planning and Asset Protection

For individuals without adequate insurance coverage, Medicaid often becomes the eventual funding source for long-term care. However, Medicaid eligibility requires meeting strict income and asset limitations, which can result in the loss of family wealth accumulated over a lifetime.

Medicaid planning involves legal strategies to protect assets while still qualifying for benefits when needed. These strategies must be implemented well in advance of needing care, as Medicaid has look-back periods that examine financial transactions for several years prior to application.

Proper Medicaid planning can help preserve assets for spouses and beneficiaries while ensuring access to necessary care. However, these strategies require careful implementation with qualified legal and financial professionals to avoid penalties or disqualification from benefits.

Estate Planning Integration

Long-term care planning works best when integrated with comprehensive estate planning. Various legal documents and structures can provide protection and ensure your wishes are followed if you become unable to make decisions independently.

Powers of attorney for health care and finances allow trusted individuals to make decisions on your behalf when necessary. These documents should be carefully crafted to address long-term care scenarios and coordinate with your overall planning strategy.

Trusts can offer additional asset protection while providing flexibility for managing resources throughout your lifetime. Certain types of trusts may help protect assets from long-term care costs while preserving them for beneficiaries.

Family Communication and Planning

Successful long-term care planning requires open communication with family members about preferences, concerns, and financial realities. These conversations, while sometimes difficult, help ensure everyone understands the plan and can work together if care becomes necessary.

Family members should understand your care preferences, know the location of important documents, and be familiar with

your financial and legal planning strategies. Essential family discussion topics include:

- Your preferred care settings and providers

- Location of important legal and financial documents

- Health care directives and power of attorney arrangements

- Insurance policy details and contact information

- Financial resources available for care expenses

- Regular review meetings to address changing needs

Frequently Asked Questions About Long-Term Care Planning

Q: What is the difference between long-term care insurance and health insurance?

Long-term care insurance specifically covers custodial care services like assistance with daily activities, while health insurance covers medical treatments and procedures. Traditional health insurance, including Medicare, provides very limited coverage for long-term care services.

Q: When should I start planning for long-term care?

The ideal time to start long-term care planning is in your 50s or early 60s when you're still healthy and insurance premiums are more affordable. However, it's never too early to begin considering your options and preferences for future care needs.

Q: How much does long-term care insurance cost?

Long-term care insurance premiums vary widely based on your age, health, coverage amount, and policy features. Annual premiums typically range from $1,500 to $5,000 for comprehensive coverage, with costs increasing significantly if you wait until older ages to purchase.

Q: Will Medicare pay for my long-term care?

Medicare provides only limited long-term care coverage under specific circumstances. It covers skilled nursing facility care for up to 100 days following a qualifying hospital stay, but does not cover custodial care that most people need for daily activities.

Q: What happens if I can't afford long-term care insurance?

If insurance isn't affordable, consider alternative strategies like hybrid life insurance policies with long-term care riders, setting aside dedicated savings, or working with an attorney on Medicaid planning strategies to protect assets while qualifying for benefits.

Q: Can I use long-term care insurance for home care?

Yes, most long-term care insurance policies cover home care services, assisted living, and nursing home care. Many people prefer to use their benefits for home care to remain in familiar surroundings as long as safely possible.

Q: How do I know if I need long-term care planning?

Everyone should consider long-term care planning since 70% of people over 65 will need some form of long-term care. If you have assets you want to protect, family members you don't want to burden, or specific care preferences, planning becomes especially important.

Q: What is Medicaid planning and is it legal?

Medicaid planning involves legal strategies to protect assets while qualifying for Medicaid benefits to pay for long-term care. These strategies are completely legal when properly implemented by qualified professionals, but require advance planning due to Medicaid's look-back periods.

Q: Can long-term care planning help protect my home?

Yes, proper planning can help protect your home through various strategies including certain types of trusts, spousal protections, and Medicaid planning techniques. However, these strategies must be implemented well before care is needed to be effective.

Q: Should I involve my family in long-term care planning?

Absolutely. Family involvement ensures everyone understands your preferences, knows where important documents are located, and can work together if care becomes necessary. Regular family discussions about care preferences and financial arrangements are essential for successful planning.