It is not always necessary to formally open a probate estate in order to distribute assets belonging to a decedent. For smaller estates, a less formal administrative probate process is available.

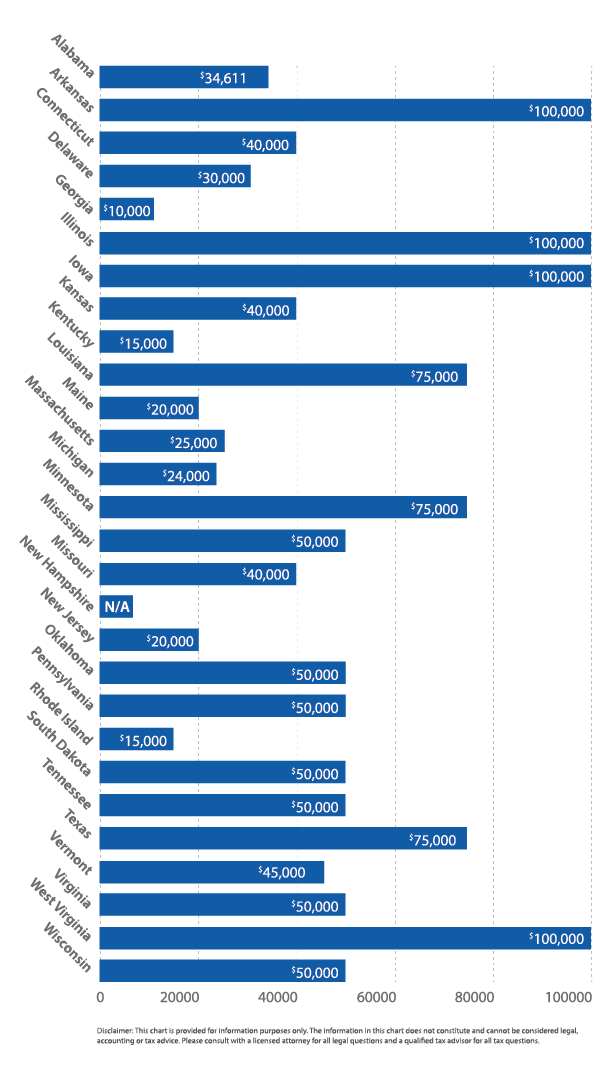

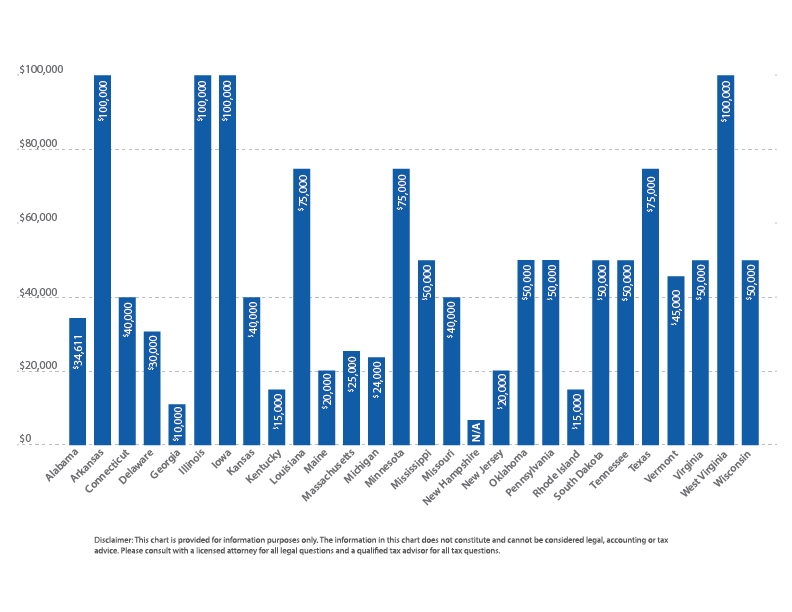

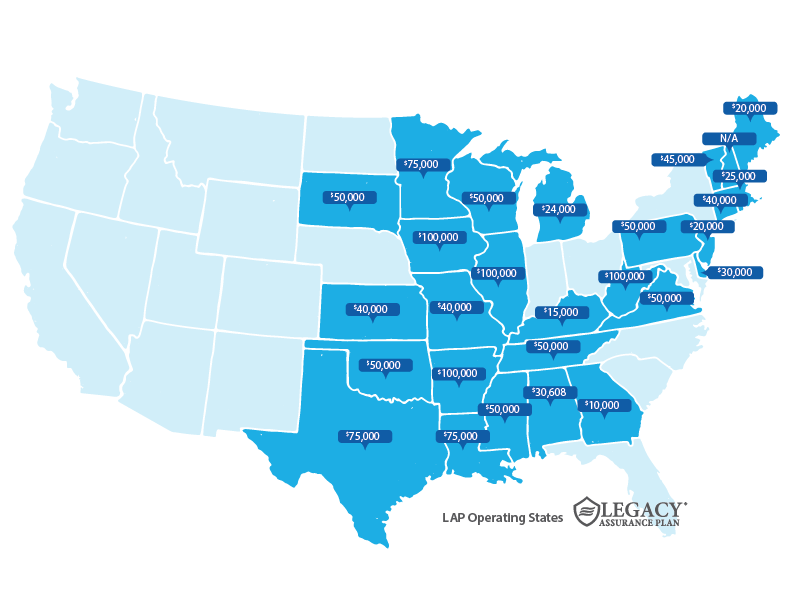

Administrative probate is only available to estates below a stated value. Most states established a maximum value, usually between $10,000 and $100,000 — called the probate threshold — of an estate to use this more informal probate process. The threshold amount and other requirements vary by state. If the estate holds real estate, administrative probate is not available.

If the estate meets the qualifications for administrative probate, a small estate affidavit (the actual document title is state-specific) is prepared. This document is sufficient to transfer the assets to the beneficiaries without opening an estate or appointing a personal representative. Administrative probate is inexpensive since the required form is usually available from the court clerk's office and an attorney is not needed. It's typically used for bank accounts with nominal balances.

Probate Threshold

The probate threshold varies by state and determines whether a less formal probate procedure can be used. If the total value of assets held by the decedent in his or her individual name exceeds this amount, then it's likely that a formal probate process will be required. However, only an attorney can make that deterimination.

In the event the assets held in the individual name of the decedent are less than the threshold, a simplified version of probate may be required, or even no probate at all.

A will cannot protect from probate, guardianship or Medicaid.

On average, probate can consume as much as 3-8% of your estate.

Probate can delay distribution of assets for up to 18 months or more.