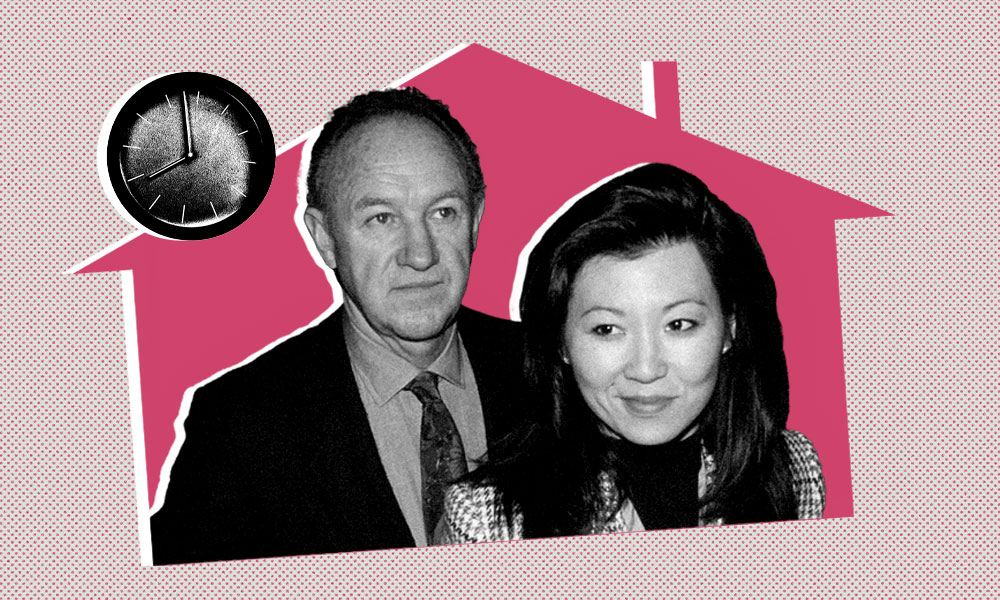

A mere 24 hours could have transformed the outcome of Gene Hackman's estimated $80 million estate. When the acclaimed Oscar-winning actor and his wife of over 30 years, Betsy Arakawa, were discovered in their Santa Fe, New Mexico, home in February 2025, few realized that the precise timing of their deaths could potentially trigger a cascade of legal consequences with far-reaching implications for their heirs.

Medical examiners determined that Arakawa died first and Hackman survived about six days longer. This particular detail crossed a critical threshold in New Mexico law with the potential to redirect millions of dollars and alter the inheritance destinies of multiple families.

Far from being just a celebrity curiosity, the Hackman-Arakawa case exposes a hidden vulnerability in many Americans' estate plans. The uncomfortable truth? Your carefully crafted will or trust may be entirely undermined by circumstances you never considered. A situation similar to the Hackman estate could happen to families of any financial standing — and most people remain completely unaware of this risk until it's too late.

What happens when spouses die close together?

When spouses die within a short time of each other, state laws can determine how certain assets are distributed. In the Hackman-Arakawa case, New Mexico's version of the Uniform Simultaneous Death Act establishes that if two people die within 120 hours (five days) of each other, they are legally presumed to have died simultaneously.

This presumption serves several important purposes:

- It prevents assets from transferring from one estate to another only to be distributed again shortly thereafter.

- It eliminates double administrative costs and probate proceedings.

- It ensures assets go directly to each person's respective beneficiaries rather than passing through both estates.

Authorities announced that Arakawa died first from hantavirus pulmonary syndrome, with Hackman succumbing seven days later to atherosclerotic cardiovascular disease. Since they died approximately 144 hours apart — exceeding the 120-hour threshold — the state’s default simultaneous death provision would not apply to their estate.

It's important to note that these state laws only apply to assets passing through probate when no other controlling documents exist. Assets with designated beneficiaries (like life insurance and retirement accounts), assets held in trusts and assets with joint tenancy with right of survivorship follow their own rules regardless of the timing of deaths.

How does the timing of death affect estate distribution?

When one spouse survives the other by more than the statutory period, the assets of the first-to-die spouse generally transfer to the surviving spouse, who may then only live briefly afterward. In the Hackman case, since Arakawa died first and more than 120 hours passed before Hackman's death, her assets would legally have transferred to Hackman before his death, even though he was reportedly suffering from advanced Alzheimer's disease and may not have been aware of her passing.

Timing can create several significant implications for any estate. TMZ reports that Arawaka’s last will and testament included a provision that says if they died within 90 days of each other, their deaths would be considered simultaneous. Without the 90-day provision, Arakawa's share of their joint assets would have legally transferred to Hackman's estate. Hackman's will would then determine the distribution of the combined assets.

What estate planning tools can address a simultaneous-death situation?

Standard estate planning documents can include customized survivorship provisions, like Arakawa’s, that extend the presumed simultaneous death period beyond the statutory minimum. Many estate planning attorneys recommend extending this period to 30, 60 or even 90 days to better reflect the client's wishes.

Revocable living trusts offer flexibility in addressing survivorship issues. With properly structured trusts, you can specify exactly how assets should be distributed if your spouse or partner survives you by various periods of time. For example, a trust could provide that if a spouse survives by less than 90 days, assets bypass them entirely and go directly to children or other named beneficiaries. This approach can prevent double administration costs, reduce estate tax consequences, ensure assets reach your intended beneficiaries and protect beneficiaries from potential creditor claims against the surviving spouse's estate.

Life insurance policies with carefully selected beneficiary designations can provide liquidity and support to specific heirs regardless of the timing of deaths. By naming primary and contingent beneficiaries, you can help ensure funds go directly to your chosen heirs, bypassing probate entirely.

Why do blended families need special estate planning consideration?

Blended families face unique estate planning challenges, as demonstrated by the Hackman-Arakawa case. Without proper planning, children from previous relationships may be unintentionally disinherited when assets pass to a surviving spouse who then distributes them to their own children or family members.

Hackman had three adult children — Christopher, Elizabeth and Leslie — from his previous marriage, while Arakawa had no children of her own. This family structure creates potential conflicts of interest that require careful planning. Estate planning professionals typically recommend creating separate trust shares for different beneficiary groups in such situations. Qualified terminable interest property (QTIP) trusts can provide for a current spouse while preserving assets for children from previous relationships. In addition, clearly documenting your intentions regarding which assets should go to which beneficiaries helps prevent misunderstandings and potential litigation after death. Regular reviews and updates of beneficiary designations on retirement accounts, life insurance policies and other assets that pass outside of a will are also crucial.

How can incapacity complicate estate planning?

Another critical lesson from the Hackman-Arakawa case involves the intersection of incapacity and estate planning. Since Hackman was suffering from Alzheimer's disease at the time of their deaths, it’s a scenario that could raise questions about his capacity to make financial decisions or changes to estate plans.

Without proper incapacity planning documents in place before cognitive decline begins, families may face:

- Court-supervised guardianship or conservatorship proceedings.

- Difficulty managing ongoing financial affairs.

- Challenges to the validity of wills or trusts signed during periods of questionable capacity.

- Family disputes over the incapacitated person's true wishes.

What essential documents should every estate plan include?

A comprehensive estate plan should address both death and incapacity. Essential documents include several key components that work together to form a complete strategy.

A financial power of attorney authorizes someone you trust to manage your financial affairs if you become incapacitated. It can be immediate or "springing" (taking effect only upon incapacity) and should be durable, meaning it remains in effect during incapacity. Given Hackman's reported Alzheimer's diagnosis, a financial power of attorney would have been crucial for managing his financial affairs prior to his death.

Health care powers of attorney and living wills name someone to make medical decisions on your behalf if you cannot communicate and outline your wishes regarding life-sustaining treatment. They help ensure your health care preferences are honored even when you cannot express them.

Wills, revocable living trusts and beneficiary designations are used to direct how your assets should be distributed after death. A revocable living trust has the additional advantage of avoiding probate and providing privacy regarding your assets and beneficiaries. Beneficiary designations determine who receives assets that pass outside your will, such as life insurance proceeds, retirement accounts and payable-on-death accounts. They should be reviewed regularly and coordinated with your overall estate plan to avoid unintended consequences.

Conclusion

The Hackman-Arakawa scenario highlights a critical yet often overlooked aspect of estate planning: how the timing of death between spouses can significantly impact asset distribution. Their situation — with deaths occurring approximately one week apart — demonstrates how even short time differences can trigger different legal mechanisms for inheritance.

Beyond statutory provisions like New Mexico's 120-hour simultaneous death rule, effective estate planning requires customized solutions that address multiple contingencies. The complexity in the Hackman family structure, with children from a previous marriage and a spouse of over 30 years, mirrors the challenges many blended families face when balancing competing interests and expectations.