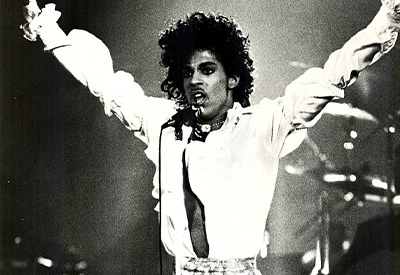

The music world was shocked by the sudden death of the recording artist known as Prince on April 21, 2016. The iconic musician left behind a vast legacy of music and an estate valued at hundreds of millions of dollars. However, he also left behind something unexpected: no last will and testament or personalized estate plan. This major oversight led to years of legal battles among his family members and others, public scrutiny and valuable lessons for everyone about the importance of estate planning, wills, trusts, probate and asset protection – regardless of your wealth or fame.

When did Prince die?

Prince Rogers Nelson died on April 21, 2016, at the age of 57. He was found unresponsive in an elevator at his Paisley Park recording studio and home in Chanhassen, Minnesota. The cause of death was later determined to be an accidental overdose of fentanyl, a powerful synthetic opioid, with paramedics estimating he had been dead for at least six hours before they arrived.

In the days leading up to his death, Prince had shown signs of ill health. On April 7, 2016, he postponed two performances due to what was reported as influenza. On April 15, his private plane made an emergency landing in Moline, Illinois, where he was briefly hospitalized. Despite these health concerns, Prince made a brief public appearance at Paisley Park on April 16, assuring fans he was OK.

Who inherited Prince’s money?

Prince's untimely death set off a legal frenzy over his fortune that would last for over six years. With no will in place, the court was tasked with determining the rightful heirs to his substantial estate. Initially, dozens of people came forward claiming to be relatives, including alleged children and distant cousins. After extensive genetic testing and legal scrutiny, the court identified six legal heirs: Prince's sister and five half-siblings.

The lack of clear directives led to numerous disputes among the heirs, ranging from how to manage Prince's vast catalog of unreleased music to the valuation of his estate for tax purposes. The Internal Revenue Service (IRS) contested the initial $82.3 million valuation, claiming it was undervalued by $80 million. This dispute alone resulted in additional tax demands and potential fines. As the legal battle raged on, two of Prince's siblings passed away, further complicating the proceedings as their shares fell to their own heirs. The public nature of the probate process exposed details about Prince's wealth and potential heirs, inviting scrutiny and false claims that a well-crafted estate plan could have prevented.

What happened to Prince’s estate after he died?

In the days and weeks following Prince's death, the lack of an estate plan led to immediate complications:

- No executor. With no will to name an executor or personal representative, the court had to appoint a special administrator to manage the estate. A local financial institution, Bremer Trust, was initially given this role.

- Search for heirs. Without clear instructions from Prince, the court had to determine his rightful heirs according to Minnesota's intestacy laws. This process opened the door for numerous claims from alleged relatives.

- Inventory of assets. The special administrator had to undertake the complex task of identifying and valuing all of Prince's assets, including his vast music catalog, unreleased recordings and real estate holdings.

- Tax implications. The lack of estate planning meant that Prince's estate faced a hefty tax bill, with federal and state estate taxes potentially claiming nearly half of the estate's value.

As the administration of Prince's estate got underway, a series of legal battles erupted, turning the process into a drawn-out and public spectacle. One of the first challenges was determining Prince's rightful heirs. Under Minnesota law, in the absence of a surviving spouse or children, the estate would pass to parents, siblings and their descendants. Prince's parents had both passed away, leaving his siblings as the primary heirs.

However, the situation was complicated by claims from individuals alleging to be Prince's children or other relatives. Over 45 people came forward claiming to be Prince's wife, children, siblings or other relatives. The court ordered genetic testing to verify these claims, a process that took considerable time and resources.

In the end, the court recognized six heirs: Prince's sister Tyka Nelson and five half-siblings - Sharon Nelson, Norrine Nelson, John Nelson, Alfred Jackson and Omarr Baker.

Why was the management of Prince’s estate disputed?

The management of Prince's estate became a source of contention following the music icon’s death in 2016. Bremer Trust's role as special administrator was temporary, and in early 2017, Comerica Bank & Trust was appointed as the permanent administrator. This transition was not smooth, with disputes arising over the handling of Prince's valuable music catalog and unreleased recordings.

The heirs often disagreed with Comerica's decisions, leading to multiple court filings and delays in the estate's administration. These disputes centered around issues such as:

- The valuation of Prince's assets.

- Deals made for the commercialization of Prince's music.

- The management of Paisley Park, Prince's home and studio.

- The release of previously unreleased music from Prince's vault.

One of the most significant challenges faced by Prince's estate was the tax bill. In 2020, the IRS claimed that the estate's administrators had undervalued it by 50%. The IRS valued the estate at $163.2 million, nearly double the $82.3 million value claimed by the estate's administrators.

This discrepancy led to a tax court battle, with the estate facing a potential additional $32.4 million in federal taxes, plus a $6.4 million "accuracy-related penalty." The dispute centered largely around the valuation of Prince's music catalog and his name and likeness rights.

It took nearly six years of legal battles and negotiations before Prince's estate was finally settled. In January 2022, the parties reached an agreement on the distribution of Prince's assets.

What did Prince’s death teach us about estate planning?

Prince's death serves as a stark reminder of the importance of proper estate planning. Here are key lessons we can draw from this experience:

- Everyone needs an estate plan. Regardless of your wealth or fame, having an estate plan is crucial. It ensures that your assets are distributed according to your wishes and can help avoid family disputes and lengthy legal battles.

- Protect your privacy. Prince was known for being fiercely private, yet the lack of an estate plan made his financial affairs a matter of public record. A well-crafted estate plan, particularly one involving trusts, can help maintain privacy even after death.

- Consider tax implications. Proper estate planning can help minimize tax burdens on your estate. Strategies such as setting up trusts or making lifetime gifts can reduce the estate tax bill, leaving more for your intended beneficiaries.

- Update your plan regularly. Life changes, and so should your estate plan. Regular reviews and updates ensure that your plan remains aligned with your current wishes and circumstances.

- Address unique assets. For individuals with unique assets like intellectual property rights, it's crucial to work with professionals who understand how to value and manage these assets. Prince's vast music catalog and unreleased recordings posed particular challenges in valuation and management.

- Choose executors and trustees wisely. Select individuals or institutions that have the expertise to manage your estate effectively. This is particularly important for complex estates or those with unusual assets.

- Communicate your wishes. While your will and other estate planning documents are crucial, it's also important to communicate your wishes to your family. This can help prevent misunderstandings and conflicts after you're gone.

Conclusion

Prince's musical legacy remains influential and valuable, but the years of legal battles and public scrutiny following his death were surely not what he would have wanted. The resolution of his estate, while finally providing closure, came at a significant cost in terms of time, money, and family harmony.

For the rest of us, Prince's story serves as a powerful reminder of the importance of proper estate planning. By taking the time to create a comprehensive estate plan, we can protect our assets, provide for our loved ones, and ensure that our legacies are preserved according to our wishes. Whether your estate is worth millions or much more modest, the lessons from Prince's case apply: Plan ahead, be thorough and don't leave your legacy to chance.

In the end, one tribute we can pay to Prince's memory is to learn from his oversight. By taking control of our estate planning, we can ensure that our own legacies, whatever they may be, are protected and preserved for generations to come.